- How we help you

Back

- Owner drivers

Back

- All benefits

- Calculate earnings

- Find loads & return journeys

- Leave multidrop

- Expand your network

- Manage finances

- Courier companies

Back- All benefits

- Calculate earnings

- Find loads & return journeys

- Reduce dead miles

- See average courier rates

- Find subbies

- Manage your fleet

- Shippers

Be your own boss. Set your own hours. Make your own money.

Courier Exchange is the UK’s biggest courier platform. It gets you access to over 15,000+ daily loads. And everything owner drivers need to make more money and grow.

Calculate your potential earnings

Trusted by logistics leaders

Testimonials

What our members are saying about us.

I could not have got started without the exchange I had a handful of customers when I started and the exchange kept me busy.

Steve Edwards

S Edwards Limited

From a family perspective, the Exchange has given me the freedom and flexibility to work for who I want, when I want and where I want.

Mike Puplett

The Courier Guy

Courier Exchange is the market leading platform for all couriers and hauliers. A must for any business trying to resolve the headache of “driving empty”. Great communication at their office when needed. With features and applications that get better year on year

Steve Beckett

Speedy Fleet Couriers

This CX platform is without doubt the best transport / shipping platform in the UK hands down!

Barry Little

Simpex Express

Courier exchange is an amazing platform, perfect for build and grow your business, and help provided step by step.

Nicoleta Capusneac

Around 60 percent of my work comes from CX. It’s introduced me to large clients in the automotive and aviation industries, and customers in the events and real estate sectors.

Nick Nappi

Nick Of Time Logistics

Live loads

Check out all the loads posted today on CX.

Our platform

15,000 daily loads. And the best tech in the business.

Here’s what you can do with Courier Exchange…

Find outbound loads

There are more than 15,000 courier loads posted to CX every day. No other UK platform has so many loads available.

Apply now

With CX, self-employed couriers can search live maps to find loads in the nearby area. Which means, as a self-employed courier, you always have access to a steady stream of loads to deliver… so you can make your own money and grow your own business.

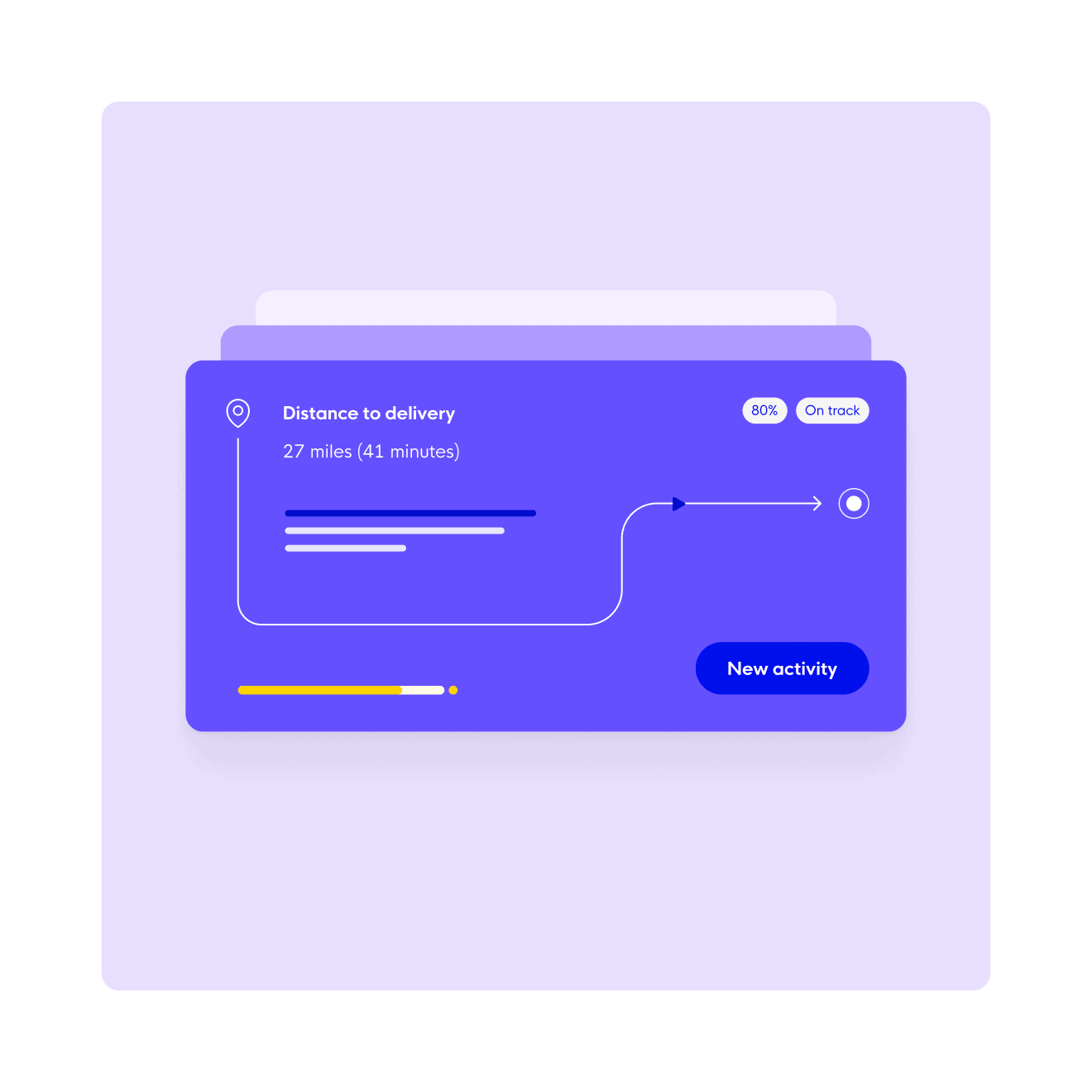

Find return loads

With the CX app, you have access to loads all over the country. That means, once you’ve delivered a load, you don’t need to drive back empty.

Instead, open the CX app and find a load that needs to be delivered on your way home.

That way, you make money on the way out… and on the way back.

Apply now

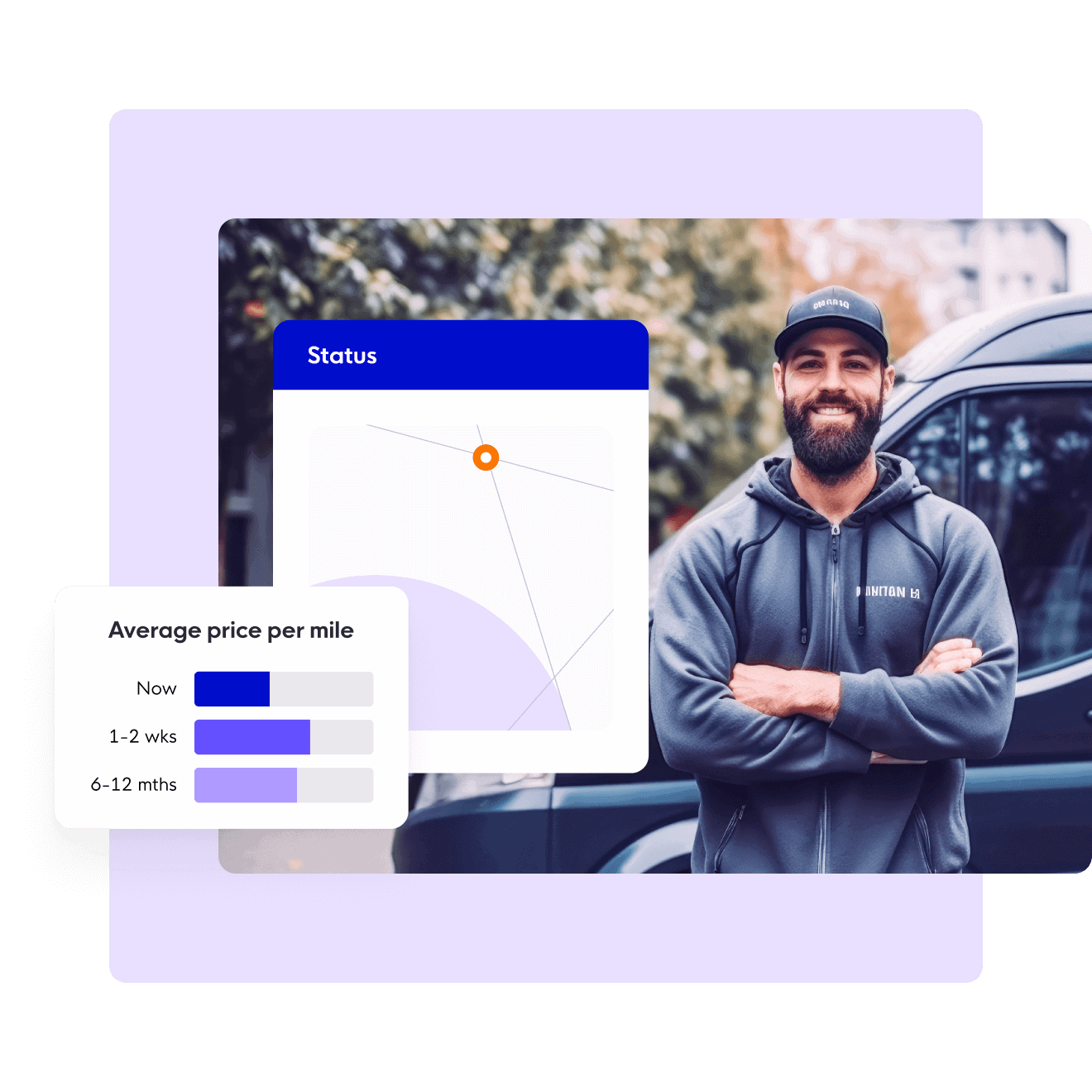

Win more work

The courier industry is competitive. Getting your pricing right is crucial – especially if you’re new.

CX can show you average prices per mile for vans like yours going to and from certain locations, and the data is updated weekly.

That means, with CX, you can quote strategically to win more work… even if you’re new to the courier business.

Apply now

Let the loads find you

With CX, you can find your own loads. But you don’t even need to do that.

There are more than 15,000 loads posted to CX every day. And 44.7% of those go unsold… which means CX shippers are always looking for drivers.

With CX, you can let shippers know when you’re empty. Simply set your status to ‘available’ in the CX app. Then sit back and wait for shippers to contact you.

Apply now15,000+

The average number of daily loads posted to CX

2.27 million

The number of loads delivered by CX members last year

99.2%

The average member-to-member positive feedback rating on CX

Escape multi–drop

Dropping multiple parcels at multiple locations day in, day out can be hard.

The majority of CX loads are A-to-B. One pick up point. One drop off point.

With CX, you can make your own money. Without working so hard.

Apply now

Advertise loads

As an owner driver, your capacity is limited. So when you’re offered two jobs at once, you usually have to turn work down.

With CX, though, you can book subcontractors. So you can accept both jobs and partner with other CX members to make sure both loads are delivered.

That means, with CX, you don’t just get loads. You get a platform to help you grow your courier business.

Apply now

Work with some of the UK’s biggest shippers

Shippers need to trust you. If you’re new, that can be a problem.

When you join CX, though, you also get Trustd. Trustd is cutting-edge tech that demonstrates your compliance and professionalism.

That means shippers know they can trust you. Which means you can work with some of the UK’s biggest shippers – even when you’re new.

Apply now

Manage finances

It can be hard for owner drivers to keep track of payments.

CX lets you send shippers digital invoices. And it automatically shows you:

– when your invoices have been approved

– when your invoices have been paid

– when your invoices are outstandingWith CX, you can check you’ve been paid in seconds – and do something about it when you haven’t.

Apply now

Expand your network

With CX, you’re part of a community of more than 10,000 insiders.

And, thanks to the CX Directory, you can contact other members in your area. To partner up. For everyone’s gain.

With CX, life as a courier isn’t such a struggle – because shippers in your area want to work with you.

Apply nowAccess requirements

What you need to join

Courier Exchange is a membership-only platform. We only accept serious and professional courier businesses as members.

To join CX you must have your own van (although you can lease one if you don’t own one).

You also need to submit the following for consideration:

- Your driving licence

- Hire and Reward insurance

- Goods in Transit insurance

- One proof of address

- Certificate of Incorporation (if applicable)

- VAT number (if applicable)

Should you meet our requirements, you’ll be invited to join the platform.

Apply nowOne perfect plan

Our friendly team will help you onboard quickly and get started with our platform.

Solutions

Resources

Support

About

2000 - 2026. Transport Exchange Group Ltd, Reg No. 3464353 © E&OE

- Owner drivers