If you’re just getting started as a courier, you’ve probably already sorted your van and your courier insurance. But what happens if your van breaks down halfway through a job?

Having the right breakdown cover can save you time, money, and hassle when you’re out on the road. Whether you’re a solo driver or managing a small team, picking the right policy means less stress when things go wrong.

In this guide, we’ll walk through what’s included in breakdown cover for courier vans, typical costs, the difference between personal and business policies, and which providers to consider.

What we’ll cover

Get access to 15,000+ loads a day on Courier Exchange

Be your own boss. Set your own hours. Make your own money.

What is breakdown cover for courier vans?

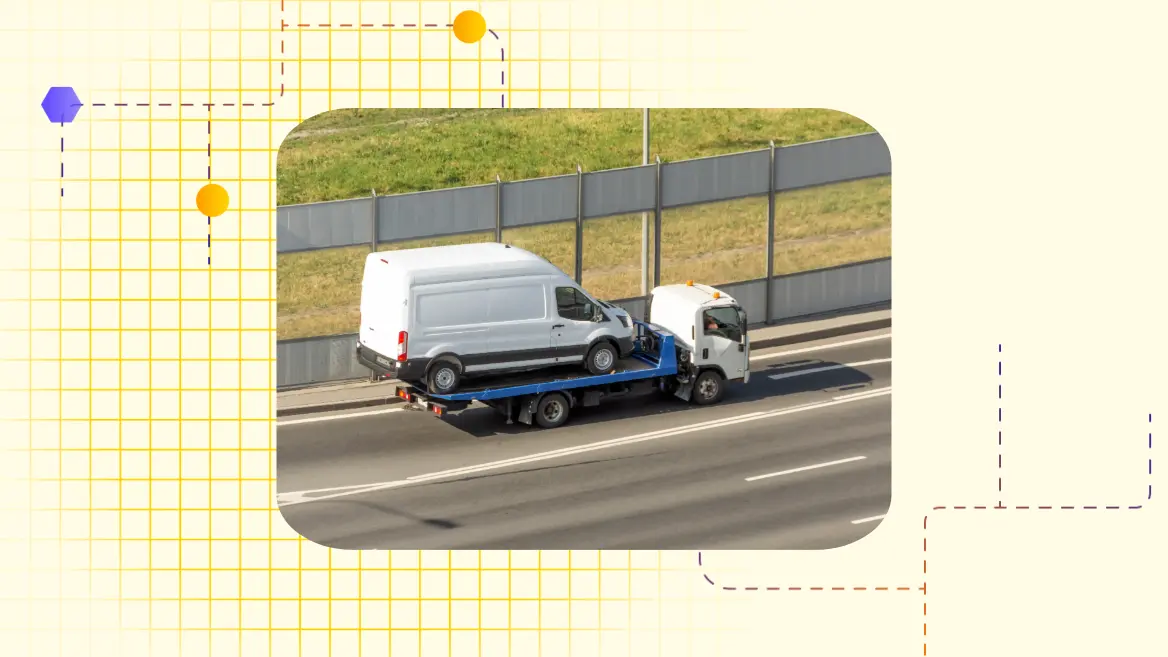

Breakdown cover helps you get back on the road if your van fails.

For couriers, that means you won’t be left stranded mid-job, which helps protect your earnings and your reputation.

What does a typical policy include?

Most breakdown cover policies include some or all of the following:

- Roadside assistance if your van breaks down away from home

- Local recovery to a nearby garage

- National recovery, taking you and your van to any destination in the UK

- Home start if your van won’t start at your home address

- Onward travel or a hire van to keep you moving

If you take on overnight courier jobs, look for providers that offer support 24/7.

How courier policies differ

Standard breakdown cover is built for personal vehicles. But breakdown cover for business use takes your workload into account.

Courier-specific policies may offer:

- Faster response times for business users

- Recovery for commercial van breakdown cover

- Add-ons like cover for trailers or refrigeration units

If you’re using your van for international courier work, make sure the provider includes European breakdown cover or offers it as an add-on.

How much does breakdown cover cost?

Prices can vary depending on your van, usage, and the level of cover you need.

Factors that affect the price

Several things can push the cost up or down, including:

- Vehicle size and weight – 3.5 ton van breakdown cover is usually more expensive

- How old your van is

- How many call-outs are included per year

- Whether you want national recovery or just local assistance

If you’re working with a second-hand courier van, be prepared to pay a little more, especially if it’s over ten years old.

Example price ranges

For a single courier van, you can expect to pay:

- Basic roadside cover: £50–£80 per year

- Mid-level cover with recovery: £80–£130 per year

- Full business cover with extras: £130–£200+ per year

Fleets usually get discounted rates, especially if you’re insuring multiple vehicles under the same policy.

Choosing the right breakdown cover

There’s no one-size-fits-all approach. The right cover for you depends on how and where you work, what kind of van you drive, and whether you’re operating solo or as part of a team.

Individual couriers vs fleets

If you’re a self-employed courier driver with one van, a single-vehicle policy might be enough. But if you’re running multiple vans or plan to expand, look at multi-van or fleet policies.

Fleet policies are often cheaper per vehicle and come with simpler admin. This works well if you’re already thinking about fleet management.

Make sure the policy covers commercial vehicles, not just personal cars.

Business-specific needs

Your policy should match the type of courier work you do. Ask yourself:

- Does the provider offer cover for courier vans, or is it just general business use?

- Will they tow your van anywhere in the UK if needed?

- Can they offer you a like-for-like hire van, or just a small car?

- Are there limits on the age or mileage of the van?

If you often work outside standard hours, look for providers that operate 24/7 with minimal wait times.

Top providers of breakdown cover

Several providers offer commercial van breakdown cover, with varying features and pricing.

Here are a few well-known names:

- The AA – Offers flexible cover, with bolt-ons for courier-specific needs

- RAC – Well-known for business breakdown options and optional European cover

- Green Flag – Often cheaper and uses a large network of independent garages

- Start Rescue – Popular with couriers for offering good value on basic plans

Check if they include courier vehicle tracking or a mobile app so you can monitor the recovery status in real-time.

Each provider has its own terms, so it’s worth comparing the fine print.

What to watch out for in the small print

Not all breakdown cover for business use includes everything you might assume.

Here are a few things to look out for:

- Call-out limits: Some policies only allow a certain number of recoveries each year

- Van age restrictions: Older vans might not be eligible for full cover

- Recovery exclusions: Some providers won’t tow to your destination if it’s far from the breakdown point

- Third-party repairs: You may need to pay upfront and claim later

Always check what’s included before signing up. Some exclusions might affect you more than others, especially if you’re just starting out or relying on a second-hand van.

Frequently asked questions

What’s the difference between personal and business van breakdown cover?

Personal policies are designed for everyday drivers and often exclude business usage. If you’re using your van for deliveries, you’ll need breakdown cover for business use or breakdown cover for courier vans.

Driving without the correct cover could mean your policy’s void.

Is 3.5 ton van breakdown cover different from standard van cover?

Yes. Vans over 3.5 tonnes are classed as heavy vehicles, and many standard breakdown providers won’t cover them. If you drive a heavier van, always check that the provider offers breakdown cover for commercial vehicles at that weight class.

Can I get short-term breakdown cover for courier vans?

Some providers offer monthly or short-term business cover, but these are less common and can cost more. Most couriers choose annual policies for better value and consistency. Short-term cover might suit seasonal drivers or those doing temporary self-employed courier driver jobs.

Does breakdown cover for business use cover me across the UK?

Usually, yes. National recovery is included in mid- to top-tier packages. But always check the exact terms—some budget policies only offer local towing. If you’re doing jobs across the country or taking on overnight courier jobs, national recovery is worth having.

What should I do if I break down mid-delivery?

First, contact your breakdown provider and arrange recovery. Then let your client or the shipper know. It’s helpful to have your courier insurance and delivery details on hand in case you need to file a claim or reschedule the drop-off.