- How we help you

Back

- Owner drivers

Back

- All benefits

- Calculate earnings

- Find loads & return journeys

- Leave multidrop

- Expand your network

- Manage finances

- Courier companies

Back- All benefits

- Calculate earnings

- Find loads & return journeys

- Reduce dead miles

- See average courier rates

- Find subbies

- Manage your fleet

- Shippers

Category: Compliance & HSE

If you’re just starting out as a courier driver, you’ve probably already heard about PCNs, or Penalty Charge Notices. They can feel like part of the job, especially when you’re delivering in towns or cities where parking is tight and time is limited.

But too many PCNs can eat into your profits, waste your time, and make running your courier business harder than it needs to be.

In this guide, we’ll explain what PCNs are, how they affect couriers, and what you can do to stay one step ahead.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.What are PCNs and who issues them?

When we say PCNs, we’re usually talking about two types of parking charges that get sent through the post. They might look the same at first, but they come from different authorities and follow different rules.

Understanding the types of PCNs

The first type is the Penalty Charge Notice, usually issued by councils or Transport for London. These are official charges under traffic regulations. They apply if you stop in a loading bay for too long, park on double yellows, or enter a bus lane, for example.

The second is the private parking charge, issued by companies like ParkingEye or Euro Car Parks. These apply in supermarket car parks, business estates, or hospital grounds. These aren’t fines in the legal sense. They’re invoices for breaching the terms of private land use.

Both are commonly called PCNs, but they come from different places and carry different weight.

Private parking charges vs council PCNs

Private parking charges are based on contract law. If you park on private land, signs at the entrance usually outline the terms (e.g. 2 hours free for customers). If you break those terms, the company may send a charge to the registered keeper of the vehicle.

Penalty charge notices, on the other hand, come under civil law. Local councils enforce them through ANPR cameras or traffic wardens. If you ignore these, they can be passed to enforcement agents and lead to court action.

It’s worth knowing that only penalty charge notices can lead to bailiff action without a separate court case. For private parking charges, the company must win a claim in the small claims court before anything else happens.

Why courier drivers get so many PCNs

Doing courier jobs means you’re on the road all day, often with tight deadlines and unpredictable drop-off points. That puts you at higher risk of PCNs, especially in busy areas.

You might stop in a loading bay for five minutes longer than allowed. Or return to a street for a second drop, only to get caught by ANPR cameras set up for restricted repeat visits. In some towns, you’ll struggle to find any legal parking within walking distance of the customer.

Many new drivers also stop in private car parks—supermarkets, petrol stations, or hospitals—to grab lunch or take a break. These places often have ANPR cameras and hidden time limits.

And if you’re covering overnight courier jobs, you’re more likely to use car parks late at night when enforcement still applies, but signage is harder to see.

The job puts you in these spots every day. That’s why courier drivers need to be clued up on PCNs early on.

What to do when you receive a PCN

It’s frustrating to get a notice through the post, especially if you feel you were doing your job properly. But it’s always better to act quickly.

How to appeal council-issued PCNs

For penalty charge notices, you usually have 28 days to respond. If you pay within 14 days, the charge is often reduced by 50%. But if you think it’s unfair, you can challenge it.

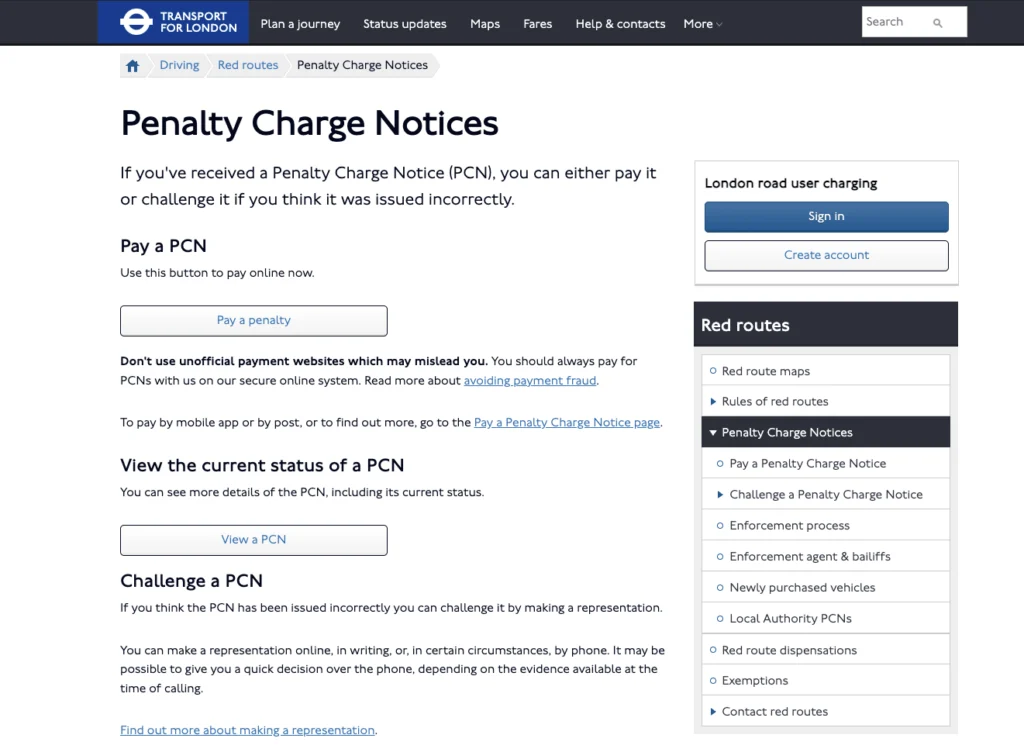

Submit an appeal online or in writing. For example, if you were issued a PCN by Transport for London, you can pay or appeal the fine on their portal.

Include evidence like delivery logs, GPS vehicle tracking, or time-stamped photos. If you were loading or unloading goods, say so—and provide proof. Couriers are allowed to stop in many restricted areas if the stop is for work and clearly documented.

If the council rejects your appeal, you can take it to an independent tribunal.

How to appeal private parking charge notices?

You can also appeal private parking charges, and many get cancelled when properly challenged. Start by contacting the company with your evidence.

Was the signage poor? Did you stay for less than the grace period? Were you actively working on a delivery? Mention all of that.

If they reject your appeal, you can take the case to POPLA (Parking on Private Land Appeals). Their decisions are independent, and many appeals are successful when there’s strong evidence.

Don’t just ignore a private parking charge. While some companies don’t follow up, many do. If they take the case to court and win, you could end up with extra fees or even a CCJ.

According to the British Parking Association, over 50% of private parking charge appeals are cancelled at the first stage or through POPLA. Common successful appeal reasons include:

- Poor or unclear signage

- Active loading/unloading with proof

- Medical emergencies or broken-down courier vehicle

- Time overstays of less than 10 minutes (within grace period)

The hidden costs of PCNs for courier businesses

It’s not just about the cost of the fine. PCNs affect your time, your admin, and your mental load.

- You lose income every time you pay a fine

- Appeals take time, especially if you’re running solo without office support

- A string of unpaid charges could end up hurting your credit, especially if they go through court

- If you hire vehicles or subcontract, sorting out who’s responsible takes time and energy

Over a month, just a few PCNs can undo the profit from several runs. And that’s before you factor in rising costs like courier van diesel costs and courier insurance.

How to reduce your risk of getting PCNs

The good news is, many PCNs are avoidable once you know where the traps are.

Plan your drop-offs with restrictions in mind

Use mapping tools that show red routes, loading zones, and parking restrictions. Apps like Parkopedia and JustPark can help you find legal spots close to your delivery points.

You can also mark regular drop-offs where restrictions apply, so you know what to expect on repeat visits.

This is especially useful if you’re doing international courier work, where local parking rules can change from one authority to another.

Use delivery evidence to cover yourself

Keep a record of every drop—time, address, and activity. A photo of your van at the delivery location, or a timestamped receipt, can go a long way in an appeal.

Even a screenshot from your delivery app helps show you were on legitimate business.

It’s worth taking that extra 20 seconds, especially if you’re stopping in a spot where enforcement is likely.

Helpful tools and habits for new couriers

Building good habits early makes a big difference.

Set time each week to check for new PCNs. Don’t let appeals pile up. Keep digital folders for receipts and photos. If you subcontract, agree up front who handles fines and how appeals work.

Here are a few tools and practices that help:

- PayByPhone and RingGo for on-the-go parking payments

- Snap Parking for commercial parking and truck-friendly stops

- Subscribe to council updates about congestion charges and traffic schemes

- Bookmark pages like the Dartford Crossing charge portal to avoid missed deadlines

You’ll also want to keep VAT receipts from car parks or road fees. Even though private parking charges aren’t VAT-qualifying, related expenses like council charges and tolls can be.

Typical PCNs costs across the UK

Not all PCNs cost the same. Charges vary depending on where the offence happened and what type of rule was broken. Some areas are much stricter than others, especially if you’re delivering in larger cities or regulated zones.

Here’s a quick overview of common penalty charge notice rates across major UK cities:

PCN charges in major UK cities

City Average PCN Fee Notes Birmingham £70 (£35 early payment) City centre restrictions, ANPR and bus lane zones Manchester £60 (£30 early payment) Includes time-limited bays and loading restrictions Glasgow £60 (£30 early payment) City-wide parking and traffic enforcement Leeds £70 (£35 early payment) Covers city centre, bus lanes and school zones Bristol £60 (£30 early payment) Often issued for restricted parking and loading These amounts can add up fast if you’re doing multi-drop or 24-hour courier service work.

While most authorities offer discounts for early payment, appealing or challenging the notice is often worth it, especially if you were delivering at the time.

PCN charges in London boroughs

London is a different beast. Each borough sets its own rates, and many apply higher charges for more serious offences.

If you’re navigating London, understanding the fee structure can help you avoid unnecessary costs.

Borough/Authority Average PCN Fee Notes Transport for London (TfL) £160 (£80 early payment) Red routes, bus lanes, yellow box junctions Westminster £130 (£65 early payment) Very active enforcement in central zones Camden £130 (£65 early payment) Includes residential zones and loading areas Hackney £130 (£65 early payment) Frequent patrols and bus lane monitoring Islington £130 (£65 early payment) Strict rules around schools and cycle lanes Haringey £110 (£55 early payment) Less central but still active enforcement Southwark £130 (£65 early payment) Controlled zones and ANPR use in high-traffic areas These fees apply per offence, and London boroughs often use ANPR cameras and mobile patrols to catch violations.

If you’re picking up overnight courier jobs or running through multiple zones in a day, you’ll want to plan your route carefully and factor in things like toll roads, congestion charges, and parking access.

You’ll also find that some of the best locations for couriers are just outside the stricter central boroughs, offering easier parking and fewer restrictions.

Get access to 19,000+ daily loads on Courier Exchange

Be your own boss. Set your own hours. Make your own money.

Sign upFrequently asked questions

What’s the difference between a PCN and a private parking charge?

A Penalty Charge Notice is issued by public bodies, like local councils or Transport for London. A private parking charge comes from a company managing parking on private land. Both are referred to as PCNs, but they follow different legal routes.

Will a PCN affect my credit rating?

Not always. Council penalty charge notices won’t appear on your credit file unless bailiff action escalates. But if a private parking charge goes unpaid and the company takes you to court—and wins—it could result in a CCJ if ignored.

Can I appeal if I was on a delivery?

Yes. Whether it’s council or private, evidence matters. Provide proof of delivery time and location. Explain why the stop was necessary, and include any relevant documents. Many appeals are successful when there’s a clear work-related reason.

How long do I have to deal with a PCN?

Usually 28 days from the issue date. If you pay within 14 days, you often get a discounted rate. But don’t wait too long—late appeals might not be accepted, especially for penalty charge notices.

What if the PCN was sent to my courier company?

If you’re driving a hired or company-owned vehicle, the notice might go to them first. They’ll often nominate you as the driver, passing the liability on. Always check your hire agreement or contract to see who’s responsible for PCNs.

If you’re a courier, you know that delivering parcels safely and on time is your top priority. But what happens when things go wrong? What if a package gets lost, damaged, or stolen during transit?

That’s where Goods in Transit (GIT) Insurance comes in. It’s your safety net, ensuring you’re not left out of pocket when the unexpected happens.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.What Is Goods in Transit Insurance?

Goods in Transit Insurance (GIT) is a type of cover that protects goods while they’re being transported. Whether you’re using your own van or a third-party service, this insurance covers:

- Loss: If a parcel goes missing during transit.

- Damage: If goods are damaged due to an accident or mishandling.

- Theft: If goods are stolen from your vehicle or during the delivery process.

It’s essential for anyone involved in transporting goods, as it helps relieve financial risks associated with lost or damaged items.

Why do couriers need it?

Imagine this – you’re driving along, and suddenly, another vehicle swerves into your lane, causing you to brake sharply. A parcel shifts and gets damaged. Without GIT insurance, you’re liable for the cost of that item. But with the right cover, your insurance can help cover the replacement or repair costs.

Moreover, GIT insurance isn’t just about protecting goods; it’s also about protecting your reputation. If a client receives a damaged item or a parcel goes missing altogether, it reflects poorly on you. Having insurance shows you’re professional and prepared for such situations.

How does it differ from other insurance?

You might wonder, “I already have van insurance; isn’t that enough?” While van insurance covers your vehicle and any damage you cause to others, it doesn’t cover the goods you’re transporting. That’s where Goods in Transit insurance comes in – it specifically covers the items in transit.

Plus, GIT insurance can be tailored to your specific needs. For instance, if you’re transporting high-value items, you can opt for a policy that provides higher coverage limits. Some policies also offer tools and equipment cover, which is handy if you’re carrying expensive scanning devices or other gear.

The stats: How big is the problem?

In the UK, parcel delivery issues are more common than you’d think. According to Citizens Advice, nearly 15 million people experienced a problem with a parcel delivery in just one month. That’s a staggering number!

One of the major players in the delivery industry, Evri, reported losing approximately 8 million parcels in 2025 alone. While they handle around 800 million parcels annually, this still means a 1% failure rate, which is a significant figure when dealing with millions of items.

Overall, 7.4 million people in the UK have fears that the parcels they send and receive are at risk of being stolen.

These statistics highlight the importance of having GIT insurance. With so many deliveries going missing or getting damaged, being covered ensures you’re not left financially exposed.

What does GIT Insurance typically cover?

A standard GIT insurance policy covers:

- Accidental Damage: If goods are damaged due to an accident or mishandling.

- Theft: If goods are stolen during transit.

- Loss: If goods go missing and cannot be recovered.

However, it’s important to note that not all items are covered. Common exclusions include:

- Poor packaging: If goods are inadequately packed, they might not be covered.

- High-Risk items: Some policies exclude high-risk items like cash, jewellery, or hazardous materials.

- Unattended vehicles: Theft from an unattended vehicle might not be covered unless specific security measures are in place.

Always read the policy details to understand what’s included and excluded. If you speak to our partners Business Choice Direct (BCD), they will explain everything to you to simplify the process.

How do I choose the right level of cover?

Getting the right level of GIT Insurance is all about understanding what you’re carrying, how often you’re working, and what risks you’re exposed to. Consider the value of the goods you transport and the risks involved.

For high-value courier items (electronics, jewellery, designer goods), you’ll need a higher level of cover, possibly with extra conditions like tracking or signed delivery. For low-value or bulk items (clothing, books, food) a basic level of cover might be enough.

If you do ADR courier work, including hazardous or perishable items, you may need specialist GIT insurance.

Make sure you consider special risks as well. For example, if you need overnight storage in vehicle or regularly do overnight courier jobs, you may need a clause to cover cargo theft when goods are left in the van. If you undertake multiple drops per day, because more stops means higher risk of theft or loss, this will affect your premiums. If you do long-distance hauls or Europe delivery, make sure the policy covers long-range and international courier work.

Make sure your policy includes theft, accidental damage, loss in transit and loading and unloading incidents. Also check the excess (how much you pay if you make a claim) and claim limits per item. Some insurers limit payout to a certain amount per parcel.

It’s better to have slightly more cover than you think you’ll need than to be underinsured. This is where it is valuable talking to a knowledgeable broker like BCD, who can advise you of appropriate cover to meet your needs and explain the policy in a straightforward way.

So to summarise, here are some things to consider when buying cover.

- Does this cover multiple drops a day?

- Am I covered if goods are stolen from a locked van?

- Are there any restrictions on what I can carry?

- Will this policy meet platform requirements (like Courier Exchange, Amazon, Evri, DPD)?

While this might seem like an additional expense, consider it an investment in your business’s protection and professionalism.

What happens if a parcel goes missing?

If a parcel goes missing or is damaged, stay calm. Accidents and issues happen in this job. The key is how you handle them.

Note the time, location, and any unusual circumstances (e.g. bad weather, vehicle break-in, etc.). Check your vehicle tracking system or delivery app. Double-check your route and delivery location.

Report it immediately

Let your employer, dispatcher, or delivery platform know what’s happened ASAP. If you’re self-employed, contact the client or shipper directly. Use the appropriate internal reporting system or email. Some delivery platforms (like Amazon Flex, DPD, etc.) have specific loss/damage reporting tools.

- Gather evidence: take photos and write down any details that might support your case:

- If damaged: photograph the item and packaging.

- If stolen: check for vehicle or depot break-in evidence. Look around for CCTV or witnesses if the loss happened at a public location.

Check your insurance

If you have GIT Insurance, now’s the time to check your policy and start the claims process. If you don’t have GIT cover – now’s the time to call the helpful team at BCD!

Note that if you don’t have GIT insurance and the load or parcel is valuable, you might be liable for the cost of the item depending on your contract.

How can you avoid issues in the future?

Scan items at every point, get signatures or photo evidence and avoid risky “safe places”, and always keep your van locked and secure.

Could you have improved security? Did something about the drop-off point seem unsafe? Do you need better courier insurance or tracking procedures?

Most delivery apps show proof of delivery and that you followed the delivery instructions exactly. If you did, you’re usually not held responsible, but always check your company’s policy.

You’re human, and things occasionally go wrong in this line of work. What matters is that you act quickly, communicate clearly, and protect yourself with the right cover and good delivery habits.

Goods in Transit Insurance is a vital safety net for couriers. It protects you financially and helps maintain your professional reputation. With parcel delivery issues on the rise, having the right insurance in place is more important than ever. Stay protected, stay professional, and drive with confidence.

Why use Business Choice Direct?

The experience team at BCD make getting insurance quick, simple, and cost-effective.

They understand the everyday challenges couriers face. With years of experience in reliable, competitive courier insurance, BCD can help you save time, money, and avoid costly mistakes.

Their cover isn’t off-the-shelf – it’s tailor-made to suit your specific needs. What may not be your top priority is always theirs!

Contact the helpful team at BCD on 0330 043 0098, or submit your details here.

Ready to see how you can build your business on CX?

Register nowGIT insurance FAQs

Am I automatically liable for lost or damaged goods?

Not always. It depends on your contract and whether you have GIT insurance. Some companies/platforms will cover you if you followed procedures.

What if the customer claims it never arrived but I delivered it?

Use your delivery records, tracking info, and photo evidence. If your process was correct, you’re unlikely to be held liable.

Is GIT insurance mandatory?

No, Goods in Transit insurance it’s not legally required. However, many clients and delivery platforms, like Courier Exchange and Amazon, require it before you can transport goods for them or their members.

Does GIT insurance cover damage caused by my own negligence?

It depends on the policy. Some insurers may cover such incidents, while others might exclude them. Always check your policy details.

Can I get GIT insurance if I’m a part-time courier?

Yes, GIT insurance is available for both full-time and part-time couriers. Policies can be tailored to suit your needs.

Does GIT insurance cover goods stored overnight in my vehicle?

Typically, no. Most policies exclude cover for goods left unattended overnight. However, some insurers offer optional add-ons for this scenario.

If you’re just getting started as a courier, you’ve probably already sorted your van and your courier insurance. But what happens if your van breaks down halfway through a job?

Having the right breakdown cover can save you time, money, and hassle when you’re out on the road. Whether you’re a solo driver or managing a small team, picking the right policy means less stress when things go wrong.

In this guide, we’ll walk through what’s included in breakdown cover for courier vans, typical costs, the difference between personal and business policies, and which providers to consider.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.What is breakdown cover for courier vans?

Breakdown cover helps you get back on the road if your van fails.

For couriers, that means you won’t be left stranded mid-job, which helps protect your earnings and your reputation.

What does a typical policy include?

Most breakdown cover policies include some or all of the following:

- Roadside assistance if your van breaks down away from home

- Local recovery to a nearby garage

- National recovery, taking you and your van to any destination in the UK

- Home start if your van won’t start at your home address

- Onward travel or a hire van to keep you moving

If you take on overnight courier jobs, look for providers that offer support 24/7.

How courier policies differ

Standard breakdown cover is built for personal vehicles. But breakdown cover for business use takes your workload into account.

Courier-specific policies may offer:

- Faster response times for business users

- Recovery for commercial van breakdown cover

- Add-ons like cover for trailers or refrigeration units

If you’re using your van for international courier work, make sure the provider includes European breakdown cover or offers it as an add-on.

How much does breakdown cover cost?

Prices can vary depending on your van, usage, and the level of cover you need.

Factors that affect the price

Several things can push the cost up or down, including:

- Vehicle size and weight – 3.5 ton van breakdown cover is usually more expensive

- How old your van is

- How many call-outs are included per year

- Whether you want national recovery or just local assistance

If you’re working with a second-hand courier van, be prepared to pay a little more, especially if it’s over ten years old.

Example price ranges

For a single courier van, you can expect to pay:

- Basic roadside cover: £50–£80 per year

- Mid-level cover with recovery: £80–£130 per year

- Full business cover with extras: £130–£200+ per year

Fleets usually get discounted rates, especially if you’re insuring multiple vehicles under the same policy.

Choosing the right breakdown cover

There’s no one-size-fits-all approach. The right cover for you depends on how and where you work, what kind of van you drive, and whether you’re operating solo or as part of a team.

Individual couriers vs fleets

If you’re a self-employed courier driver with one van, a single-vehicle policy might be enough. But if you’re running multiple vans or plan to expand, look at multi-van or fleet policies.

Fleet policies are often cheaper per vehicle and come with simpler admin. This works well if you’re already thinking about fleet management.

Make sure the policy covers commercial vehicles, not just personal cars.

Business-specific needs

Your policy should match the type of courier work you do. Ask yourself:

- Does the provider offer cover for courier vans, or is it just general business use?

- Will they tow your van anywhere in the UK if needed?

- Can they offer you a like-for-like hire van, or just a small car?

- Are there limits on the age or mileage of the van?

If you often work outside standard hours, look for providers that operate 24/7 with minimal wait times.

Top providers of breakdown cover

Several providers offer commercial van breakdown cover, with varying features and pricing.

Here are a few well-known names:

- The AA – Offers flexible cover, with bolt-ons for courier-specific needs

- RAC – Well-known for business breakdown options and optional European cover

- Green Flag – Often cheaper and uses a large network of independent garages

- Start Rescue – Popular with couriers for offering good value on basic plans

Check if they include courier vehicle tracking or a mobile app so you can monitor the recovery status in real-time.

Each provider has its own terms, so it’s worth comparing the fine print.

What to watch out for in the small print

Not all breakdown cover for business use includes everything you might assume.

Here are a few things to look out for:

- Call-out limits: Some policies only allow a certain number of recoveries each year

- Van age restrictions: Older vans might not be eligible for full cover

- Recovery exclusions: Some providers won’t tow to your destination if it’s far from the breakdown point

- Third-party repairs: You may need to pay upfront and claim later

Always check what’s included before signing up. Some exclusions might affect you more than others, especially if you’re just starting out or relying on a second-hand van.

Ready to see how you can build your business on CX?

Register nowFrequently asked questions

What’s the difference between personal and business van breakdown cover?

Personal policies are designed for everyday drivers and often exclude business usage. If you’re using your van for deliveries, you’ll need breakdown cover for business use or breakdown cover for courier vans.

Driving without the correct cover could mean your policy’s void.Is 3.5 ton van breakdown cover different from standard van cover?

Yes. Vans over 3.5 tonnes are classed as heavy vehicles, and many standard breakdown providers won’t cover them. If you drive a heavier van, always check that the provider offers breakdown cover for commercial vehicles at that weight class.

Can I get short-term breakdown cover for courier vans?

Some providers offer monthly or short-term business cover, but these are less common and can cost more. Most couriers choose annual policies for better value and consistency. Short-term cover might suit seasonal drivers or those doing temporary self-employed courier driver jobs.

Does breakdown cover for business use cover me across the UK?

Usually, yes. National recovery is included in mid- to top-tier packages. But always check the exact terms—some budget policies only offer local towing. If you’re doing jobs across the country or taking on overnight courier jobs, national recovery is worth having.

What should I do if I break down mid-delivery?

First, contact your breakdown provider and arrange recovery. Then let your client or the shipper know. It’s helpful to have your courier insurance and delivery details on hand in case you need to file a claim or reschedule the drop-off.

Taking on international courier work can open up more profitable opportunities for UK-based drivers. European loads often pay better, especially for longer distances or urgent shipments. If you’re just starting out as a courier, working abroad might sound like a big step, but with the right prep, it’s very doable.

In this guide, we’ll look at what you need to get your van and documents ready for courier work abroad, from breakdown cover and vehicle checks to what sort of jobs you can expect on the platform.

Let’s get your van ready for the road.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.What documents do you need for courier work abroad?

You can’t cross into the EU without the right paperwork. And once you’re in, you’ll need to keep these documents to hand in case you’re stopped or asked at a border.

Passport, permits and customs documents

Make sure your passport is valid for at least six months. Some EU countries also ask for an International Driving Permit (IDP), depending on where you’re going and how long you’ll stay.

Always carry your:

- Full UK driving licence

- Green card (from your insurer)

- Vehicle V5C logbook

- T1 or T2 transit documents (only for specific loads going through customs checks)

Operator licence and CMR notes

You don’t need a full O-licence if you’re only using a van under 2.5 tonnes for your own loads. But if you’re subcontracting or carrying goods for others, you may need one – especially post-Brexit.

Make sure you’ve got CMR insurance and a completed CMR consignment note for each cross-border load. These are standard documents for international goods transport and protect both you and your customer if anything goes wrong.

Vehicle checks for long-distance EU courier work

Long drives across Europe mean you’ll need your van in top condition. Nobody wants to break down halfway across France with a frozen shipment in the back.

Before heading out, run these basic checks to keep on top of your courier van maintenance:

- Tyres: pressure, tread depth, and condition

- Oil and coolant: top up before long journeys

- Brakes: check responsiveness and pad condition

- Lights: all bulbs should be working

- Load area: check for any damage or loose fittings

- Documents: keep copies in the glove box and on your phone

If you’re running frozen and chilled transport, double-check that your fridge unit is compliant with EU standards and serviced recently.

Having a well-maintained van helps avoid delays and shows you’re reliable, especially when bidding for higher-paying international courier work.

Get the right cover in place

Accidents and delays can happen anywhere, but they’re harder to sort when you’re hundreds of miles from home.

That’s why it’s smart to check what your courier van breakdown cover includes before you set off.

Do you need separate European breakdown cover?

Yes. Most UK policies don’t include the EU unless you’ve paid extra.

A decent European policy should offer:

- Roadside repair in EU countries

- Towing to a nearby garage

- Hotel stays or vehicle repatriation

- 24/7 helplines (make sure you’ve got the EU number saved)

Some providers also offer multilingual support, which can be helpful in a stressful situation.

Cross-border courier insurance

Standard van cover won’t always apply once you cross the Channel. You’ll need a policy that extends to EU countries and includes:

- Courier insurance valid in Europe

- Goods in transit cover

- Public liability insurance (check if this still applies abroad)

- CMR insurance for loads covered under the CMR Convention

If you’re regularly doing international courier deliveries, speak to your broker and make sure your policy fits the work you’re doing.

Prepare for border checks and customs delays

Cross-border jobs often involve longer waits at ports or terminals. Since Brexit, checks are tighter, and every country has its own process.

Be ready to show:

- Vehicle and driver ID

- Load documents and any permits

- Details of the shipper or freight forwarder

Plan your route with extra time for delays. Keep calm if you’re stopped, it’s part of the job. And remember, some countries charge extra fees on toll roads, so have a payment method ready or get a tag in advance.

If you’ve got a regular route through a specific port or border, use that to your advantage when looking for repeat European loads. Clients prefer drivers who know the process and can avoid common delays.

Why international courier work can help grow your business

Most international courier work pays more than local jobs. That’s down to the added paperwork, time, and risk. But for drivers who prepare properly, it can be a steady source of work, and it can help you stand out.

Higher rates and long-term clients

Jobs that cross borders usually have better rates, especially if you’re covering long distances or transporting urgent items. Many freight forwarders will shortlist drivers who’ve done EU courier work before and know the paperwork.

Repeat work is common too. Once a shipper knows you can handle courier work abroad, you’ll be front of mind when they post new loads.

You can also earn more by offering extras, like:

- Multi-drop in different countries

- Timed delivery

- Refrigerated or fragile goods transport

- Late-night or 24-hour courier service

These are all in demand for cross-border deliveries.

Stand out on Courier Exchange

Platforms like Courier Exchange let you filter by route, region, and job type. You can target international courier work directly, and tailor your profile to highlight your experience with European loads.

Make sure your feedback score stays high, and note any extra services you offer. Drivers who’ve done music festival courier jobs, for example, often get repeat summer bookings due to their reliability under pressure.

You’ll also want to track costs carefully. For example, using courier fuel cards can help keep fuel costs down when you’re travelling across multiple countries.

Ready to see how you can build your business on CX?

Register nowFrequently asked questions

Do I need a special licence for EU courier work?

Not always. For vans under 2.5 tonnes, you don’t need a full operator licence unless you’re subcontracting or working for someone else. If you’re using a larger vehicle, check with DVSA for current rules.

How much can I earn doing courier work abroad?

Rates vary depending on the load, distance, and urgency. However, many drivers report higher pay for international loads, especially time-critical or specialist deliveries.

Can I take refrigerated goods into Europe?

Yes, but your van needs to meet EU transport standards. You’ll also need the right insurance and paperwork, especially for perishable items that are transported using cold chain logistics.

What if my van breaks down in Europe?

That’s where European breakdown cover comes in. It can cover roadside repairs, hotel stays or getting your van (and load) back to the UK. Always keep emergency numbers handy.

Where can I find regular self-employed courier driver jobs abroad?

Courier Exchange is a great place to start. You can search for self-employed courier driver jobs that include courier work abroad, or filter by international destinations to match your preferred routes.

Whether you’re new to courier work or running your own van full-time, staying legal on the road is part of the job.

One area that can catch owner-drivers out is the MOT. It’s easy to overlook in a busy week, but driving without a valid MOT can lead to more than just a fine. It can stop you working.

This guide breaks down the legal bits around driving without an MOT, including when it’s allowed, when it’s not, and how to stay on top of it as a working courier.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.What is an MOT and why does it matter?

The MOT (Ministry of Transport) test is a legal check that makes sure your van is roadworthy. It looks at safety features, emissions, and general wear and tear.

If your van is over three years old, you need to book this check once a year at an authorised test centre.

For couriers, the MOT isn’t just paperwork. You can’t take on courier loads or drive to pick up a load if your van doesn’t pass. It’s a basic part of courier van maintenance, and without it, you’re off the road.

Can you legally drive without an MOT?

There’s only one legal reason to drive without an MOT: if you’re heading to a pre-booked MOT test. That’s it.

You must go straight to the garage. If the police stop you, they’ll expect to see proof of the booking. A text or email confirmation should do the job.

Any other journey is illegal. Whether it’s a quick collection, a job in the next town, or even popping to the shops, you’re not allowed to drive once the MOT has expired.

That applies even if the van feels fine to drive. Legally, it’s still off the road until tested.

What are the risks of driving without an MOT?

Police penalties and fines

If you’re caught driving without an MOT, the police can issue a fine of up to £1,000.

If your van has a known dangerous fault and you’re driving it anyway, the fine can go up to £2,500. You could also get 3 points on your licence or face a ban.

Police use ANPR (Automatic Number Plate Recognition) cameras, so it doesn’t take much for them to spot you. If flagged, you’ll be pulled over and asked for proof of your MOT.

Insurance invalidation

This one catches out a lot of new drivers. Most courier insurance policies require you to have a valid MOT. If your MOT is out of date and you get into an accident, your insurer might reject your claim.

That means no cover for repairs, damage to someone else’s vehicle, or personal injury costs.

Worse still, it could impact your ability to work if your van’s written off or taken off the road.

Is there a grace period for an expired MOT?

No. There’s no grace period after your MOT runs out. As soon as it expires, the van is no longer road legal. The only exception is the trip to a pre-booked MOT appointment.

Even if your MOT expired yesterday and the van feels fine, you still can’t use it for work until it passes a new test.

What happens if you accidentally drive without an MOT?

It happens. Maybe you missed the reminder, or assumed it was booked. But accidentally driving without an MOT is still illegal. The law doesn’t make exceptions for forgetfulness.

If you’re stopped and have no test booked, you could be fined. It doesn’t matter if it was an honest mistake.

What to do if you’re stopped

If the police stop you and your MOT is expired, they’ll check for a valid appointment. If you’ve got one, you might be allowed to carry on to the garage.

But if there’s no booking, expect a fine and possibly points on your licence. You might also be stopped from continuing your journey if the van is considered unsafe.

Tips to avoid driving without a valid MOT

Staying on top of your MOT doesn’t need to be a hassle. Here are a few ways to stay road legal and avoid disruptions to your work:

- Set reminders: Use your phone calendar or sign up for DVLA text alerts a month before your MOT is due.

- Book early: Try to schedule your MOT 2–4 weeks before the expiry date. It gives you time to sort repairs if needed.

- Have a backup plan: If your van fails the test, you’ll need a way to get home or to your next job.

- Use your downtime: Book your MOT on a quieter workday to reduce lost time.

- Look into MOT insurance: Some policies offer cover for replacement vehicles while yours is off the road.

Staying organised will keep your van legal and your courier work running smoothly.

When does a new van need an MOT?

New vans don’t need an MOT until three years from their registration date. After that, it’s once a year on the expiry date of your last test.

If you’re buying a second-hand courier van, check the MOT history online using the van’s reg. That way, you’ll know when the next test is due.

Get access to 19,000+ daily loads on Courier Exchange

Be your own boss. Set your own hours. Make your own money.

Sign upFAQs about driving without an MOT

Can I drive with an expired MOT if I have insurance?

No. Even if your insurance is valid on paper, the policy may not pay out if your MOT has expired. Most insurers include a clause about this. Always check the fine print.

What if I forget to renew my MOT?

You’re not alone. It’s a common issue, especially for new drivers. But it doesn’t excuse you from penalties. Set up reminders and book early to avoid last-minute problems.

Can I drive home after a failed MOT?

Only if your van is still roadworthy and no ‘dangerous’ faults were found. If the garage lists a serious issue, you’ll need to tow the van or get it fixed on-site before moving it.

Will the police know my MOT has expired?

Yes. ANPR systems check your reg against the DVLA database. If your MOT’s expired, expect to get flagged and pulled over, especially on motorways or in urban areas.

Can I tax my van without an MOT?

No. If your MOT has run out, you won’t be able to renew your vehicle tax. Once the van passes its MOT, you can tax it and get back on the road.

If you’re a courier just starting out, you might be looking for ways to stand out or take on more specialised work. One option worth considering is getting a waste carrier licence. It can open the door to a niche that’s often overlooked, but has solid earning potential and steady demand.

In this guide, we’ll explain what it is, how to apply, what it costs, and how it fits into building your courier business.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.What is a waste carrier licence?

A waste carrier licence lets you legally transport waste as part of your business. That includes any rubbish, scrap, or unwanted material you carry for someone else, whether it’s being dumped, recycled, or reused.

Even if the load doesn’t seem like “waste” in the usual sense, it can still count. For example, if you collect used tyres from a garage or move broken appliances for a council, you’ll need to register as a waste carrier.

You apply for the licence through the Environment Agency (in England), Natural Resources Wales, or the Scottish Environment Protection Agency.

There are two types of licence:

- Lower tier – for certain organisations or when you carry your own business waste.

- Upper tier – for couriers and others who transport waste on behalf of clients. This is the one you’ll need for owner driver jobs.

Common waste types carried by couriers

Couriers working in this space can end up handling a wide range of waste loads. Typical examples include:

- Scrap metal from garages or small industrial units

- Garden cuttings and soil from landscapers

- Old white goods (fridges, washing machines)

- Construction offcuts like plasterboard or timber

- Electronics and IT equipment from office clear-outs

Even if the load doesn’t smell like rubbish, it could still be classed as waste legally. It’s always best to check with the customer and Environment Agency websites if you’re unsure.

Do I need a waste carriers licence for this work?

If you’re being paid to carry anything that’s classed as waste, then yes, you likely do.

A few exceptions exist. If you’re only moving your own business waste (like packaging or damaged goods from your van), and you’re not getting paid to transport it, then the lower tier might cover you.

But if you’re picking up anything from customers – whether it’s going to the tip, a recycling site, or even being reused – you’ll need the upper tier licence.

This applies even if you only do it occasionally.

Why some couriers focus on waste work

The logistics industry is full of opportunity, but it’s also competitive. Many new couriers take on anything and everything to get started.

That can work depending on the location of your courier business, but narrowing your focus can help you build quicker.

Working as a registered waste carrier means you can tap into a more specific group of clients, including:

- Local authorities and housing associations

- Landscaping firms and garden centres

- Scrap metal dealers

- IT recycling firms

- Builders and property managers

These businesses often need someone reliable for regular clearances. If you’re consistent and easy to work with, you could find steady high-value courier jobs all year round.

Benefits of going niche

Focusing on waste loads gives you a clearer identity in the market. It can also lead to more repeat work than general pallet or parcel runs. You’re not just another van driver; you’re someone who understands how to deal with waste loads properly.

And the competition? It’s usually lower. Many couriers shy away from waste because they’re unsure about the rules. That gives you an edge if you’re willing to register and handle things properly.

This kind of work also pairs well with other specialist courier services, like moving construction materials or bulky clearances.

How much is a waste carriers licence?

The waste carrier licence cost depends on where you apply and what type you need.

In England, the upper tier licence costs around £154 for a three-year period. Renewals are usually a bit cheaper. You apply online through the Environment Agency. Scotland and Wales have similar pricing structures, though it’s always worth checking current fees on their websites.

The lower tier licence is free, but doesn’t cover you for carrying other people’s waste.

Waste carrier licence cost vs. potential earnings

At first glance, £154 might seem like a cost you can skip, but if you take just a few waste jobs a month, you’ll easily make it back.

Say a small landscaping firm hires you to clear garden waste weekly. Even at £40 per trip, that’s over £2,000 a year. That makes a waste carrier licence a pretty solid investment in your courier business.

There’s also less competition in this space, especially in smaller towns or rural areas.

And once you’re registered, you can advertise yourself as a licensed waste carrier—adding trust and professionalism to your profile.

What to expect after you apply

The application process is pretty straightforward. You’ll fill out some business details online, answer a few questions about the type of work you do, and pay the fee.

In most cases, you’ll get your licence number in a few days, and receive a certificate shortly after. You’ll also appear on the public waste carriers register, which potential load posters can search if they want to double-check your status.

Make sure your business name, contact details, and licence number are easy to find on your website or profile.

Waste carriers licence rules and compliance

Being registered isn’t just about ticking a box. You’ll need to keep basic records and follow some rules when carrying waste.

If you’re stopped by the Environment Agency or a local authority, they might ask to see:

- Your waste carrier licence certificate or number

- Waste transfer notes or job sheets

- Details of where the waste is going

It’s good practice to keep digital copies of job info, including client names, collection times, and delivery points. If you’re a member of Courier Exchange, all of your past jobs and PODs are stored online and accessible whenever you need them.

Staying compliant as a registered waste carrier

You’re responsible for what happens to the waste you carry. That means making sure it goes to an authorised facility, like a licensed tip or recycling site.

You don’t need to store waste or process it, but you do need to handle it correctly while it’s in your van.

Make sure your van’s secure and suitable for the loads you’re carrying. A van with partitions or tie-down points helps here. If you’re thinking about upgrading, our guide on buy or hire a courier van is worth a read.

Limitations of a waste carrier licence

The waste carrier licence lets you transport waste, but it doesn’t let you store it, sort it, or run a full recycling business. For that, you’d need extra permits.

There are also limits on what type of waste you can move. If you’re dealing with hazardous waste—like chemicals or asbestos—you’ll need to register for that separately. You might also need ADR certification, depending on the load type.

And of course, you’ll still need proper courier insurance, courier van road tax, and any local permits required for disposal sites.

This type of work can be messy, so keeping your van clean and well organised matters. Some drivers even invest in a second van just for waste jobs as their courier fleet grows, or upgrade to trucks to expand their per-job capacity – choosing the right truck size is important if that’s your plan. Alternatively, you can look for courier subcontractors with a waste carrier licence, and use them to expand your capacity and enable specialist waste services.

Get access to 19,000+ daily loads on Courier Exchange

Be your own boss. Set your own hours. Make your own money.

Sign upFrequently Asked Questions

How much is a waste carriers licence in the UK?

The current waste carrier licence cost for an upper tier licence in England is £154, valid for three years. Renewals cost less. This applies if you’re moving other people’s waste for money. Lower tier licences are free, but limited in scope.

You can apply online via the Environment Agency, Natural Resources Wales, or SEPA.Do I need a waste carriers licence for scrap metal?

Yes, if you’re collecting scrap metal for others (even if you’re dropping it off at a licensed yard) you’ll need a waste carriers licence.

If you’re buying and selling scrap as a business, you may also need a scrap metal dealer’s licence. Always check with your local council for extra rules.How long does it take to get a waste carrier licence?

Most drivers receive confirmation within 1 to 5 working days, depending on the agency and the accuracy of your application. Your details will also be added to the public register, which clients can search online.

Can I use my waste carrier licence across the UK?

In general, yes. If you register with the Environment Agency (England), your licence is recognised in Wales and Scotland too. But if you’re based primarily in Scotland or Wales, you should register with SEPA or Natural Resources Wales instead.

What happens if I carry waste without a licence?

You could face fines of up to £5,000 or more, and risk losing contracts with clients who require compliance. Your van might also be seized if it’s used illegally. It’s not worth the risk – especially when the licence is cheap and easy to get.

Starting out as an owner-driver means there’s a lot to juggle, but keeping on top of your courier van maintenance is one thing you can’t afford to put off. Your van is your business partner. Without it, you don’t move loads, make deliveries, or get paid.

Properly maintaining your courier van helps prevent downtime, protects your reputation, and keeps every load moving smoothly, whether you’re heading up the M1 or navigating London for multi-drops.

In this guide, we’ll share our practical tips to keep your van road-ready, reliable, and working hard for your business.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.Why maintenance matters for owner-drivers

Your van isn’t just your transport, it’s your livelihood. A breakdown could mean losing work or letting down your customers.

Staying on top of van maintenance helps:

- Reduce unexpected breakdowns.

- Stay compliant with operator standards.

- Keep fuel costs down.

- Build trust with repeat customers.

If you’re running your first van or working towards building a courier fleet, creating strong maintenance habits early can make a real difference.

With that being said, breakdowns can still happen, even with a van in tip-top condition. Make sure you get comprehensive breakdown cover for your courier van to ensure you’re not left stranded on the way to a job.

Getting a courier fuel card can also help you keep on top of fuel price surges as well.

Daily checks to keep your van roadworthy

Daily checks might feel like a chore, but a proper van driver checklist should only take you a few minutes, but could save you hours stuck at the roadside.

Tyres and pressures: a key part of your van driver checklist

Tyres are often the first thing traffic officers check. And rightly so—they’re your link to the road.

For courier work, tyre checks go beyond just pressure. Here’s what to look for each morning:

- Inspect all four tyres, including the spare, for visible damage like cuts, bulges, or embedded objects.

- Check the tread depth. The legal minimum is 1.6mm, but replacing at 3mm gives better grip in wet conditions.

- Look out for uneven wear, which might signal tracking or suspension problems.

- Confirm your courier van tyres are set to the manufacturer’s recommended pressures. Low pressures reduce fuel efficiency and can cause blowouts, especially when carrying heavier loads.

Remember, if you’re often running fully loaded, tyres will wear quicker than you expect. It’s worth scheduling tyre rotations every few months to keep wear even across all tyres.

For those who buy a second-hand courier van, tyre checks are even more important—used vans might have tyres that are close to replacement.

Security and fluids: don’t overlook the small things

- Make sure doors and locks are secure before every job. This not only protects your load but is also a van security measure against opportunistic theft.

- Top up washer fluid and check oil and coolant levels regularly.

- Test all lights, including indicators and brake lights. Don’t forget your number plate lights—they’re easy to overlook but are checked during DVSA roadside inspections.

Perform regular inspections and servicing

Preventative courier van maintenance keeps you ahead of problems and helps your van run more efficiently.

Don’t forget your load equipment

If you regularly offer specialist courier services, like ADR, fragile goods or high-value items, load security is part of your professional image.

- Inspect all ratchet straps and load restraints for signs of wear or fraying.

- Check the condition of your load bed and side rails, especially in older vans.

- Replace worn tie-down points before they fail mid-job.

Mechanical servicing and record-keeping

Stick to your van’s service schedule, whether it’s time-based or mileage-based.

- Book regular oil and filter changes.

- Schedule brake inspections to catch worn pads or discs early.

- Keep paperwork organised. Whether you’re applying for new contracts or considering buying or leasing a van, having service records builds trust and shows you take maintenance seriously.

- Consider engine remapping for your van. It could help improve your MPG and save money on fuel in the long run.

Prepare for different seasons

Weather impacts how your van performs, and how comfortable your day-to-day work feels.

Winter readiness

Colder months in the UK can add extra strain to your courier van.

- Switch to winter or all-season tyres for better grip in icy or wet conditions.

- Check the battery – cold weather can reduce its cranking power, leaving you stranded on early morning jobs.

- Treat door seals and locks with silicone spray to prevent them freezing shut.

Also, keep de-icer and a screen scraper handy for frosty starts.

Summer checks

On the other hand, British summers are usually brief and uneventful, but even short periods of hot weather can cause unexpected issues.

- Keep your coolant levels topped up to prevent overheating, especially in stop-start traffic.

- Make sure your air conditioning is working. Long hours in a hot cab without it can affect your concentration and comfort.

- If you offer frozen or chilled transport, make sure your refrigeration units are working correctly.

- In dry months, dust can clog air filters quicker, so check and replace them more often.

If you’re offering specialist services, where goods might be temperature-sensitive, these checks are even more important to protect your load.

Tips for electric and hybrid courier van maintenance

As low-emission zones and clean air policies expand, more owner-drivers are looking at electric and hybrid courier vans. If you’re considering adding one to your setup, your courier van maintenance checklist will need a few adjustments.

What’s different with EV and hybrid courier van maintenance

Electric vans and hybrids have fewer mechanical parts, but there are still important checks to make:

- Check charging cables and plugs for damage or wear.

- Inspect battery condition. Most EVs have a dashboard display showing battery health, but a periodic workshop check gives peace of mind.

- Monitor tyre wear closely. Electric vans are heavier due to battery packs, which can cause faster tyre wear—particularly on front-wheel-drive models.

Hybrids still require engine oil and filter changes, so don’t skip mechanical servicing. The regenerative braking system on both EVs and hybrids also needs checks to maintain performance.

Keep your EV or hybrid ready for courier work

- Route planning matters. Make sure charging stations are factored into your delivery routes, especially when working in rural areas.

- Keep the van’s software updated—many electric and hybrid vans get system improvements via software updates, which can improve range estimates or charging efficiency. The same goes for your vehicle tracking – make sure it’s up-to-date so you’re staying compliant.

And don’t forget—if you’re part of a fleet transitioning to electric vehicles, maintenance planning needs to adapt across all your vans, not just one.

Looking after your investment

A van is one of your biggest business costs. Whether you’re running a new model or a well-loved second-hand van, looking after it will reduce breakdown risks and prolong its working life.

If you’re still deciding between buying and leasing a courier van, remember to factor in ongoing maintenance costs alongside upfront prices.

By building maintenance into your weekly routine, you protect your vehicle, your cargo, and your business reputation.

Get access to 19,000+ daily loads on Courier Exchange

Be your own boss. Set your own hours. Make your own money.

Sign upWhen you transport dangerous goods, the job isn’t just getting them from A to B. You also need to make sure that you follow all of the safety and legal requirements when transporting these items.

That’s why couriers that move hazardous materials need to be ADR certified.

In this article, we’ll guide you through the process of getting your ADR certification and explain what’s needed to stay compliant.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.What is ADR?

ADR (Accord Dangereux Routier) stands for the European Agreement concerning the International Carriage of Dangerous Goods by Road. This agreement sets out the rules for safely transporting hazardous materials across Europe.

Couriers who carry dangerous goods, like chemicals or flammable items, must have this certification. It makes sure you know how to safely handle, load, and transport these materials.

Who needs an ADR certification?

If you’re moving hazardous goods by road, ADR certification is required. This applies to independent couriers, drivers working for transport companies, and businesses themselves.

The law is strict, and non-compliance can lead to heavy fines or even prosecution. Whether you carry hazardous loads regularly or only occasionally, this certification is important for staying on the right side of the law.

Steps to get ADR certified

Here’s a quick guide to the steps for getting ADR certified:

Step 1: Choose the right course

There are different types of ADR courses depending on what kind of goods you’ll transport. Most couriers will need the basic ADR course, but if you handle more complex materials, you may need a more advanced course.

Pick a certified training provider. The UK government website provides a list of official training centres. It’s important to select a recognised one to make sure your certification is valid.

Step 2: Enrol in ADR training

ADR training covers both theory and practical skills. You’ll learn about different types of dangerous goods, correct packing and labelling, and emergency procedures.

Courses last between 3-5 days, depending on the type of training. Make sure you attend all sessions—missing any part could mean retaking the course.

Step 3: Pass the exam

At the end of the course, you’ll take an exam. This usually involves multiple-choice questions about what you learned during training.

The exam is designed to test your practical knowledge. So, if you’ve paid attention in class, you should pass without too much trouble.

Responsibilities of load posters and forwarders posting ADR loads

It’s not just couriers who need ADR certification. Load posters and freight forwarders also have important responsibilities.

Dangerous Goods Awareness Training (DGAT): Anyone involved in transporting dangerous goods, including load posters, needs to complete DGAT. This helps them understand the risks and correct procedures.

Appointing a Dangerous Goods Safety Adviser (DGSA): Businesses involved in carrying, packing, or unloading dangerous goods may need to appoint a DGSA. This person makes sure the company is following ADR rules and meeting safety standards.

Accurate documentation: Forwarders must make sure dangerous goods are classified, labelled, and documented correctly. Without proper documentation, there can be delays or even penalties.

Safe loading practices: Load posters and forwarders need to make sure goods are loaded securely to avoid accidents during transport.

Communication of risks: It’s important to inform drivers of the specific risks with each load. Load posters must give clear instructions for safe transport and delivery.

Benefits of an ADR certification

Getting ADR certification isn’t just about following the law—it opens up new opportunities.

Many customers need couriers with ADR certification. Being certified means you can take on these higher-paying jobs, do more international courier work, and build trust with customers looking for reliable transport.

As a bonus, make sure you have vehicle tracking in your courier van, so customers know where their loads are.

Maintaining your ADR compliance

Your ADR certification lasts for five years. After that, you’ll need to take a refresher course and pass another exam to keep it valid.

ADR rules can change over time. Taking a refresher course and exam will also help you keep up to date with new regulations and the latest safety practices.

Conclusion

ADR certification is required for any courier wanting to transport dangerous goods safely and legally. The process is simple, and once certified, you’ll be able to offer more services and find new job opportunities.

Whether you work alone or for a larger company, ADR certification gives you the skills to transport hazardous goods in a safe and legal way.

Grow your business with Courier Exchange

Get access to 19,000+ loads a day, find reliable subcontractors, and manage your finances.

Sign upIn the courier business, keeping your van secure is important. These vehicles are more than just a means of transportation; they’re the backbone of your livelihood, carrying valuable goods and often operating in high-risk areas.

In the UK, 62 vans are broken into every day, an average of one every 23 minutes. Major cities like London and Birmingham take the top 2 ranks in UK van theft hotspots. But smaller towns like Tunbridge Wells and Chelmsford are also in the top 10, so it’s important to stay alert regardless of where you’re located.

So van theft is a major problem in the UK. And it affects couriers and small logistics companies severely. The loss of the vehicle itself can be financially devastating. And just as important, the loss of customer cargo can do big damage to your business’s reputation.

In this guide, we’ll share the proactive steps you can take to keep your courier van secure.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.Practical tips for keeping your van secure

1. Parking strategies

Always park your van in well-lit, busy areas. This not only deters thieves but also makes it easier for any suspicious activity to be noticed. Whenever possible, park near CCTV cameras.

Overnight, parking your van close to residential or populated areas can also be beneficial, as it increases the likelihood that someone will notice if something is wrong.

If you’re doing overnight courier delivery jobs and need to take a break along the way, try to find a busy, well-lit motorway services to park in, rather than a dark, quiet side street.

When possible, park your van against a wall or between other vehicles. This can make it difficult for thieves to access the rear or side doors.

2. Secure storage of goods

Avoid leaving valuable cargo in the van overnight. Unloading your goods and storing them in a secure location, such as a business storage facility or a locked garage at home, is a simple yet effective way to enhance van security.

Even if unloading isn’t possible, try to minimize the amount of time goods are left unattended in the van.

3. Physical van security measures

Investing in additional locking mechanisms can greatly improve the security of your van:

- Slam locks automatically lock the door when it is closed, requiring a key to reopen it. This is particularly useful for couriers who make frequent stops, as it ensures the door is always locked, even if you forget to do so manually.

- Deadlocks work by sliding a metal bolt into a bracket inside the van’s body. This is done with a key from outside the van, creating an extra secure point to lock the door, making it harder for thieves to break in

- Catalytic converter locks protect the catalytic converter – a part of the exhaust system that contains valuable metals – making it much harder for thieves to remove it from the vehicle.

Using visible deterrents such as steering wheel locks can also discourage potential thieves. The sight of these devices alone can be enough to deter a thief from targeting your vehicle.

4. Technology-based van security

Installing a GPS vehicle tracking system is a smart investment. In the unfortunate event that your van is stolen, GPS tracking can help in its quick recovery.

Alarm systems are another effective measure to keep your van secure. Not only do they alert you to any unauthorised access, but they also serve as a deterrent, as thieves are less likely to target a van that has an alarm system.

5. Insurance coverage

Ensuring that you have comprehensive courier insurance coverage is a must. Your policy should cover the theft of both the van and any goods it carries. This can safeguard your business against significant losses you couldn’t cover out of pocket.

Regularly review your insurance policy to make sure it meets your needs, especially if the value of the goods you carry changes over time.

Conclusion

Keeping your van secure requires a combination of practical measures and investment in security equipment. By parking smartly, adding additional locks, installing GPS trackers, and maintaining adequate insurance, you can reduce the risk of theft.

As a courier, your van is central to your business and losing it can be disastrous. The cost of implementing these measures is a small price to pay compared to the potential losses from a theft.

Grow your business with Courier Exchange

Get access to 19,000+ loads a day, build your client list, and manage your finances.

Sign upIf you’re moving loads for payment, standard van insurance won’t cover you. That’s where courier insurance comes in.

Whether you’re an owner-driver working independently or a courier business with a small fleet, having the right insurance in place isn’t just about staying legal—it also helps protect your income and reputation.

In this guide, we’ll cover what courier insurance involves, who needs it, and how it ties into working on platforms like Courier Exchange.

What we’ll cover

Get access to 19,000+ courier loads a day on Courier Exchange

Sign up

Be your own boss. Set your own hours. Make your own money.What is courier insurance?

Courier insurance is a collection of policies designed to protect those transporting goods for hire or reward. It’s not a single product, but a group of cover types that reflect the real-world risks involved in the courier industry.

Unlike standard vehicle insurance, which only covers personal or business driving, courier insurance considers the added exposure that comes with moving third-party goods professionally—often over long distances, to tight delivery windows.

If you’re working through platforms like Courier Exchange (CX), you’ll be expected to hold the correct insurance before taking on any work.

What does courier insurance typically include?

Because no two courier jobs are quite the same, policies are often modular. Most couriers will need at least two or three of the following types of cover.

Each of these policies is covered in more detail in its own guide. Here, we’ll give you a top-level overview.

1) Hire and reward insurance

This is the core policy every courier needs. It allows you to carry goods in exchange for payment.

Without it, any courier job you take on could invalidate your courier van insurance—even if you have comprehensive cover.

2) Goods in transit (GIT) insurance

GIT insurance protects the actual goods you’re transporting.

If the load is stolen, damaged, or lost in transit, this policy covers the cost up to the declared value.

3) Public liability insurance

If you accidentally injure someone or damage their property while making a delivery—say, by scratching a customer’s car or slipping on their driveway—public liability insurance can protect you from legal costs and compensation claims.

4) CMR insurance (for international work)

CMR insurance is usually required for cross-border loads covered by the Convention on the Contract for the International Carriage of Goods by Road.

If you’re doing international courier work, especially across Europe, this is worth looking into.

Do you need courier insurance?

In short: yes, if you’re doing courier work.

If you’re carrying goods for money, hire and reward insurance is a legal requirement. Other cover types depend on the nature of your work, the value of the goods, and what your clients require.

Most shippers and freight forwarders will ask to see proof of cover before they award a job. If you’re on Courier Exchange, your insurance must be valid, verifiable, and up to date.

Even if you’re only doing occasional work or subcontracting your courier work, you’ll still need the right cover in place.

Choosing the right level of cover

Courier insurance isn’t one-size-fits-all. The cover you need and the courier insurance premiums you’ll pay depends on your vehicle, the types of loads you carry, and the contracts you’re bidding for.

Here are a few things to consider:

Vehicle type and usage

- Vans (from small panel vans to LWB) are the most common courier vehicles.

- Motorbikes and cars doing urgent documents or local deliveries might be cheaper to insure but come with restrictions.

- If you’re running a mixed fleet that includes HGVs, you’ll need to consider haulage insurance as well.

- Make sure your policy covers business mileage and regular long-distance use.

Nature of the goods

- Are you doing high-value courier jobs like electronics or medical equipment?

- Some GIT policies exclude certain types of goods unless specifically added.

- If you’re subcontracting, make sure your cover aligns with the shipper’s terms.

Contract requirements

- Some jobs on CX or with freight forwarders will specify minimum cover levels.

- Others may ask for specific add-ons like excess protection, breakdown cover, or courier fleet insurance if you run multiple vehicles.

It’s worth discussing these factors with a specialist broker: someone who understands courier work and can tailor a policy to suit.

Common mistakes to avoid

Even experienced couriers can run into trouble if they’re not careful with insurance. Here are a few things to watch out for:

- Using standard courier van insurance for courier work – this usually won’t cover hire and reward use.

- Forgetting to update your insurer when your working hours, routes or vehicle change.

- Assuming public liability is included in your policy (it often isn’t).

- Not declaring the full value of the goods you carry under your GIT cover.

- Letting cover lapse (even for a day) can cause problems with load access on CX.

Where to get courier insurance

We recommend getting courier insurance through Business Choice Direct (BCD), our trusted insurance partner for all courier-related cover.

BCD understands the industry and works directly with couriers and logistics professionals. They also offer policies designed specifically for those using Courier Exchange.

You can request a quote quickly online or speak with a specialist advisor who can tailor a policy to your work, whether you’re just starting out or expanding your courier business.

👉 Get a quote from Business Choice Direct

Courier insurance and the Courier Exchange

Courier Exchange is the UK’s leading platform for finding and managing A-to-B courier work. Whether you’re working with shippers directly or subcontracting for freight forwarders, having the right insurance is non-negotiable.

All CX members must have:

- Valid hire and reward insurance

- Goods in Transit insurance, with at least £5,000 in cover.

- Public liability insurance, depending on the nature of the loads

Your insurance details are verified as part of the onboarding process. Keeping them updated ensures you remain eligible for jobsand gives shippers peace of mind.

Tip: Members with verified insurance and good feedback often win more repeat work.

Conclusion

As a courier, you need to protect yourself, your vehicle, and your cargo.

Hire and Reward and Goods in Transit insurance are both essential for working in the UK. Couriers operating in and out of Europe also need CMR insurance and an Operator Licence.

Having these protects you from financial loss and ensures you comply with legal requirements. And if you’re running a mixed fleet that includes HGVs, you’ll need to consider haulage insurance as well.

For the best deals on courier insurance, get in touch with Business Choice Direct and get an exclusive rate for CX members.

Grow your business with Courier Exchange

Get access to 19,000+ loads a day, build your client list, and manage your finances.

Sign upCourier insurance FAQs