- How we help you

Back

- Owner drivers

Back

- All benefits

- Calculate earnings

- Find loads & return journeys

- Leave multidrop

- Expand your network

- Manage finances

- Courier companies

Back- All benefits

- Calculate earnings

- Find loads & return journeys

- Reduce dead miles

- See average courier rates

- Find subbies

- Manage your fleet

- Shippers

2025 TEG Member Event – Recap

This year’s Member Event wasn’t just about product updates – it marked a major milestone: 25 years of the Exchange.

Leah Summan — Updated

From product launches to milestone moments, this year’s TEG Member Event brought together hundreds of member businesses to connect, explore and celebrate.

Held at Unity Place in Milton Keynes, the tech-driven space was the perfect backdrop for an evening focused on innovation, collaboration — and looking ahead to the future.

Product updates

There was a lot to share this year.

We introduced the latest platform updates — all designed to help members grow their business, improve cash flow, and work more efficiently.

Trustd Exchange Secure Collect, the latest update from Trustd, ensures every collection is secure and fully verifiable.

Drivers get proof linked to every job, reducing disputes and unlocking access to higher-value loads.

Load posters benefit from collections that meet compliance and are completed by verified drivers.Driver Management gives load posters full visibility of their subcontracted drivers.

Onboard new drivers quickly, track updates in real time, and meet compliance requirements with ease.

Plus, gain access to Secure Collect loads, ensuring every job is handled by verified drivers.Mobile SmartPay One of the most long awaited and anticipated updates is finally here.

The all-new CX Mobile app has been built to help drivers and carriers manage bookings faster and with less admin.

With features like in-app job search and enhanced navigation, drivers can take on more work and manage loads on the go all from within the app.SmartPay has already changed the way members send and receive payments.

Now, it’s helping drivers and carriers unlock cash flow faster than ever. With guaranteed Early Payment, they can get paid in minutes – not weeks or months.

It’s fast, flexible, and completely up to you. Just opt in per load and boost your cash flow when you need it.

Want more detail? Watch the full presentations now.

Awards

We love celebrating our members. Each year, our awards recognise outstanding achievements across four categories.

Here are the 2025 winners:

Gold: THREE SPIRES COURIER SERVICES

Silver: ZAID LOGISTICS

Bronze: CW LOGISTICS LTD

Gold: PASS LOGISTICS

Silver: RIK EXPRESS LIMITED

Bronze: SHIRLEY TRANSPORT SOLUTIONS LIMITED

Gold: FAST UK COURIERS LIMITED

Silver: IVCS EXPRESS LTD

Bronze: D&K LOGISTICS LTD

Gold: LOAD IN LIMITED

Silver: LUCKXY TRANSPORT PVT LTD

Bronze: DIRECT CONNECT LOGISTICS LIMITED

25 Years of Excellence award

This year, we’re celebrating a major milestone — 25 years of the Exchange.

To mark the occasion, we honoured the founding members who’ve been with us since day one with our 25 Years of Excellence award.

Planet Logistics Limited – 25 Years of Excellence award A huge thank you to:

- PLANET LOGISTICS LIMITED

- 21st CENTURY COURIERS AND LOGISTICS

- EEZEHAUL

- RACEWORLDWIDE LOGISTICS

- PANEX LIMITED

Celebrating 25 years of the Exchange

This year’s Member Event wasn’t just about product updates – it marked a major milestone: 25 years of the Exchange.

TEG25 is about celebrating our member businesses. We’re sharing stories from those who’ve joined us over the years, and how they each use the Exchange in their own way.

It’s also about looking ahead. We’re inviting members to help shape the future through our Innovator Programmes. So we can keep building a better Exchange, together.

A huge thank you to everyone who attended the 2025 TEG Member Event and made this event so memorable. See you at the next one!

On the 12th June 2024, TEG announced the release of SmartPay. This post explains the significance of SmartPay in more detail – and outlines SmartPay’s key benefits.

In the transport sector, as many of us know, it’s strangely difficult to pay and get paid.

The reasons are numerous. But perhaps the biggest reason of all is, in transport, shippers work with multiple carriers. Often, multiple times a month. It’s an efficient system that gets precise goods to precise locations at precise times. In fact, it’s quite a spectacle.

The collaboration does, however, leave shippers with an onslaught of disparate PODs and invoices.

Some carriers submit their invoices and PODs by email. Some prefer post.

Some carriers send their paperwork both by email and through the post. For bigger shippers, the administrative burden quickly adds up, triggering a chain reaction that leads to all sorts of problems – like the need to build payment files, lengthy payment terms, chase calls, delayed payments, and, sometimes, funds being transferred to the wrong places.

Surely a better way must exist?

That better way is now here. It’s called SmartPay.

Introducing SmartPay

SmartPay is the latest evolution of TEG’s popular invoice management platform, Finance Manager – but with one, major addition.

As well as managing invoices, SmartPay facilitates payments between load posters and carriers. You can use SmartPay to pay and get paid.

That might seem minor. But, as SmartPay is designed for the transport industry, it solves so many of the inefficiencies and inconveniences outlined above.

For example, with SmartPay, both load posters and carriers can see a job, its POD and its invoices – tethered together – in the same screen. You can also see payment statuses. Load posters can change payment statuses – from ‘pending’ to ‘approved’.

Crucially, SmartPay lets load posters pay all approved invoices in one transaction… no matter how many carriers posters have worked with, or how many jobs they’re paying for.

How SmartPay works

Step 1

Carriers invoice through SmartPay, and load posters approve invoices through SmartPay.

Step 2

Come payment time, load posters make a single payment for all approved invoices to their Wallet.

Step 3

SmartPay divides the payment between carriers automatically!

The above process outlines how SmartPay works. In a little more detail:

- First, carriers invoice using SmartPay

- Load posters then approve (or reject or query) invoices using SmartPay

- Come payment time, SmartPay totals all approved invoices, showing load posters how much they owe

- Load posters then make one payment – to their Wallet

- As if by magic, SmartPay distributes the single payment to multiple carriers in line with the amount each individual carrier is owed

- At the same time, SmartPay automatically marks corresponding invoices as paid

- Finally, SmartPay notifies carriers they’ve been paid via email

It’s a comprehensive system, specifically designed to make transport payments easy.

The benefits of SmartPay

SmartPay reduces admin. It reduces errors. It reduces, confusion, hassle, chase calls and headaches.

Meanwhile, it increases clarity. It can therefore increase payment speed. And, for both load posters and carriers, it increases payment transparency and visibility.

Renaming Finance Manager

For us, the innovation is so significant that we’ve updated the name of The Exchange’s invoice management feature, Finance Manager. Naturally, the feature is now called SmartPay.

With SmartPay, you can send and receive PODs and invoices. You can track, approve and query invoices. And you can pay invoices, too.

How to get full SmartPay access

If you’re yet to set up full SmartPay access, simply log in to Trustd and complete the ‘payment setup’ section of your Trustd profile. You’ll then be able to receive payments – and pay other members – using SmartPay.

SmartPay is an innovation our members have been requesting for years. We’re therefore thrilled to be releasing SmartPay to all Exchange members.

An easier way to pay and get paid awaits.

After years of development, SmartPay is here – and we couldn’t be more delighted.

All Courier Exchange and Haulage Exchange members now have access to SmartPay. To get full SmartPay access, log in to Trustd and complete the payment setup section now.

Share this post on LinkedIn

On Wednesday 12th June 2024, over 350 members gathered to connect, explore, and celebrate at our first in-person event in 5 years.

Here’s a quick round up of the event’s highlights.

Introducing SmartPay

As anticipated, the launch of SmartPay was a real highlight. After almost a decade of work, SmartPay means you can now pay and get paid through the TEG platform.

Awards

This year we recognised outstanding achievements in four categories. The 2024 winners were:

Gold: Cousins Haulage Ltd

Silver: Lee Hickton

Bronze: Navector Ltd

Gold: Empire-Xpress Ltd

Silver: Synergy Express Couriers Limited

Bronze: Rapid Despatch Logistics Ltd

Gold: Fast UK Couriers Limited

Silver: DTE Ltd

Bronze: CDP Transport Solutions LtdBronze: D&K LOGISTICS LTD

Gold: D&K Logistics Ltd

Silver: AMV Couriers Limited

Bronze: NEPS Logistics Ltd

Extra Mile Award

This year, the Extra Mile Award went to Lee Gueller, Red Rocket Couriers Ltd.

Lee received an impressive number of nominations from his peers, who praised his exceptional service, loyalty, and continuous support. Congratulations Lee for always going the extra mile./space

A huge thank you to everyone who attended and made this event so memorable.

We’re thrilled to announce the launch of our much-anticipated Referral Programme, designed exclusively for all you hardworking and dedicated Exchange members.

Here’s the deal: every time you refer a brand-new member to the Courier Exchange or Haulage Exchange, we’ll give you a £50 Amazon gift card!

It’s our way of saying thank you for being an integral part of our community and spreading the word about our platform.

Here at the Exchange, we believe in the power of connection and collaboration.

You’ve experienced first-hand how our platform can revolutionise your business, streamline operations, and make the load quoting and posting smoother than ever.

Now, with the Referral Programme in place, you have a golden opportunity to share these benefits with your friends and colleagues in the industry.

How it works

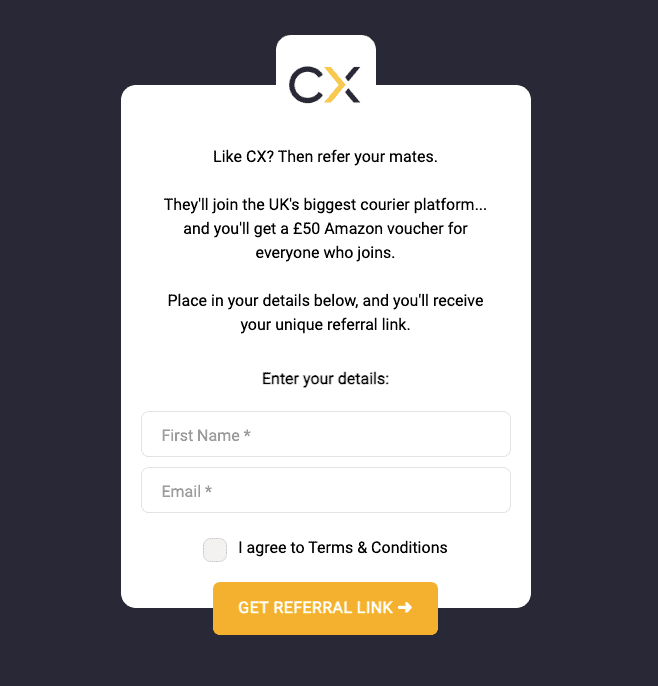

First, you’ll need to join the Referral Programme!

Click this link to create your referral account, and you’ll see something similar to the screenshot below.

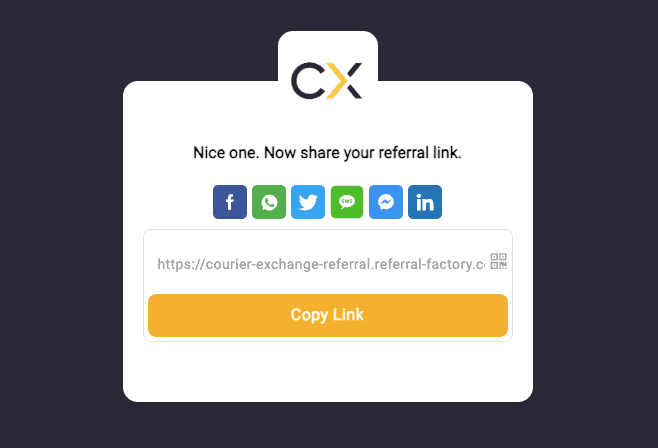

Once you’ve registered, you’ll be given a unique referral link that you can share with your friends and colleagues, across social media, your email signatures, your website and anywhere else you think will work.

Every time someone uses your referral link to join the Exchange as a brand-new paying member, you’ll get an email like the one below within 7 days to redeem your gift card.

Please note that if the person you refer is already a ‘lead’ in our system (i.e., we’ve contacted them before), it won’t count as a successful referral. Please see the terms & conditions for more on this.

When you click the Redeem £50 button, you’ll be given your Amazon gift card code.

Copy that, then head over to https://www.amazon.co.uk/gc/redeem.

Once there, add your code to the text box, click Apply to your balance, and you’re done!

So, not only will you be helping your fellow drivers and load posters grow their business and earn more, but you’ll also receive a little treat for yourself. It’s a win-win situation!

Whether you’re a seasoned member or you’ve recently joined the Exchange, we encourage everyone to participate in this programme.

We know that referrals come from a place of trust and satisfaction, so we’re confident that your recommendations will make a difference.

Terms & Conditions

Below is a summary of what you’ll need to know as a referral programme member.

- A successful referral is when a brand-new member has used your referral link to join Courier Exchange or Haulage Exchange with your link and has made their first payment.

- Successful referrals must be a brand-new member or company, and can’t already be a lead/contact in our system. If we’ve spoken to them before, or if they’re an existing CX/HX member or company adding an additional seat or user, it won’t count as a successful referral.

- Referral rewards will usually be granted within 10 days of a successful referral.

- Currently, gift cards are only redeemable on the UK version of Amazon (Amazon.co.uk) and won’t work on other Amazon country sites. We may add additional sites in the future, based on demand.

Click here for a full list of terms & conditions.

As we approach peak season, logistics companies are gearing up to cope with one of the busiest times of year.

It’s not only Christmas that brings a spike in demand for deliveries: Black Friday this November 25th is looking to generate a huge surge. Last year saw sales in excess of £9.2 bn in the UK alone, with multiple retailers launching sales events as early as the end of October.

Christmas 2021 saw retail sales rise by over 7% in the UK, but whilst that was inflated by lock-down in the first half of the year, expectations are that E-commerce will see another record-breaking season in 2022. This increase in demand calls for effective management of drivers and delivery workforce to handle seasonal spikes.

Peak pressures

If managing fleets, couriers and tracking delivery operations is hectic on normal days, it is even more complicated during peak seasons.

Recruiting and training new staff or subcontractors is just one of the demands that puts logistics and courier companies under further pressure. Advertising, recruiting, training and managing all the additional paperwork and documentation is an added headache during a time when courier companies are already overburdened.

Furthermore, efficient route planning and dispatching is critical during peak times, since the last leg of any shipment accounts for over 50% of the entire transportation costs. Any failure to deliver or use an incorrect route will increase delivery costs.

Driver recruitment

For managing the staffing side, there are several innovative workforce management technology systems available which are designed to streamline the process around onboarding, wages, contracts and admin, etc. The Courier Exchange is a great example of this, with a fully compliant network of verified professionals to make your recruitment process seamless.

Insurance

As your workforce grows to meet demand, don’t forget about the insurance side. Our insurance partner Business Choice Direct (BCD) can provide members with advice and the best rates for courier and haulage insurance.

Source: https://optimoroute.com/last-mile-delivery/

Business Choice Direct Insurance Services Ltd are authorised and regulated by the Financial Conduct Authority.

Business Choice Direct Insurance Services Ltd is registered in England and Wales No. 10301653. Registered Office: Affinity House, Bindon Road, Taunton, Somerset, TA2 6AA.

That is the message being promoted during tyre safety month this October. Tyre safety is of vital importance each and every day, and this is specifically highlighted during the month of October for the Tyre Safety Month campaign run by tyresafe.org.

According to statistics from TyreSafe, nearly 1,000 drivers are seriously injured or killed in accidents annually due to tyre-related issues. This figure is likely to rise as the economic crisis leads drivers to economise and hesitate to fit new tyres or opt for re-treads (part worn) tyres, which research has shown to be 93% non-compliant .

Don’t get caught out – get yourself covered

These stats are indeed quite scary, and not only highlight the need for safety checks, but also the importance of ensuring that you have got adequate insurance cover. It’s certainly wise to check with our insurance partners at Business Choice Direct that you’re properly protected. You can get a quote here. They can do the necessary so that you can tread carefully!

Tyre safety

Our vehicle’s tyres are the only thing connecting your car or van to the road. Not only are there safety concerns involved, but checking your tyres are in good condition has implications around optimum fuel use. Keeping your tyres at the right pressure, especially not under inflated, will help ensure your vehicle uses less energy and, therefore, less fuel. Using the correct pressure also improves the longevity of your tyres, so checking your tyres are in good repair and are correctly inflated makes economic sense too.

Tyres have to cope with braking, cornering and accelerating, which puts a great deal of pressure on their performance, which becomes especially important when the roads are wet, slippery or covered in ice or snow. They can be slightly underinflated for icy roads.

Key things to check are:

· Check tyre pressure- settings will be in your handbook

· Check for wear and tear, stones and loose objects

· Bulges could be a sign of internal damage

· Check the tread dept (1.6mm minimum)

The tyre tread pattern is designed to expel water between the tyre and the road surface, so if it is worn out, it reduces grip and increases stopping distances, whilst increasing the chances of aquaplaning. For normal car or van tyres, according to manufacturer’s Michelin, an average tyre should last around 25,000 miles.

A 15 min check could save lives

Every driver should undertake vehicle checks, not just their tyres, whether or not you drive for a living. Walkaround checks should only take you around 15 min tops. They are important to ensure that your vehicle is safe to be traveling, and that you’ll be safe as the driver. Even if it’s been on the road with another driver all day, if you take over, it’s your responsibility while you’re driving it, so it’s recommended that you do your own checks again.

Everyday checks should include:

· Tyre pressure and condition

· Brakes

· Steering

· Headlights

· Hazard lights and indicators

· Remember safe tyres save lives

· Vehicle height and width

· The height of the trailer, its load and equipment (which can change)

Accidents happen

If you are unfortunate enough to be involved in an accident, however it was caused, you’ll want to be reassured that you have got good insurance cover. That is where our insurance partners BCD come in. As mentioned earlier, it really is worth checking amongst everything else, that you have the optimum cover to meet your specific requirements.

We know that insurance may not be high on your checklist, which is why talking to the experts at BCD, who understand your business, helps to make it a fast, hassle-free process. Not only that, but their policies are comprehensive and competitive too. Remember Courier Exchange members can benefit from pre-agreed special rates.

They can also help you with any claims. You’re in good hands!

Talk to BCD now for peace of mind or call them on 0344 776 5305

Business Choice Direct Insurance Services Ltd are authorised and regulated by the Financial Conduct Authority. Business Choice Direct Insurance Services Ltd is registered in England and Wales No. 10301653. Registered Office: Affinity House, Bindon Road, Taunton, Somerset, TA2 6AA.

This research was conducted by return loads platform Courier Exchange, pulling from sources including the International Energy Agency and the World Bank.

The UK delivery market is booming, thanks largely to the rapid growth of the ecommerce market, which tripled in size between 2015 and 2021.

To support ecommerce’s meteoric rise, the UK’s domestic courier, express and parcel (CEP) market is set for a 7% compound annual growth rate in the next five years. The picture for EU nations is similar, with the EU’s overall parcel market expanding by 70% from 2015 to 2020.

The delivery industry is now having to innovate and introduce new technology to keep up with demand from the sectors that rely upon it. At the same time, governments everywhere are setting ambitious sustainability goals to bring greenhouse gas emissions down.

With this in mind, we at Courier Exchange decided to examine which European countries are set to be the biggest delivery innovators. We analysed which nations have the most potential to advance their road delivery services, based on the infrastructure currently in place and their readiness to advance further.

How we did it

We analysed data on European countries’ performance against the following metrics:

- Number of charging stations per electric vehicle (EV)

- Capacity for innovation

- Transport infrastructure

- Road quality

- Government legislation on autonomous vehicles

This data was all readily available and came from sources such as the International Energy Agency, World Bank and government websites for each country. We removed San Marino, Andorra, Belarus and Liechtenstein from the final rankings due to a lack of available data.

We compiled the data into an index and assigned a score for various criteria to produce an overall score. The higher a country’s rank, the better placed it is to be a leader in delivery innovation.

The Netherlands comes top, with the highest scores for charging points available and transport infrastructure, and scoring well for other metrics too. One initiative in the Netherlands is parcel delivery service DPD moving to become carbon-neutral in the country’s 30 biggest cities.

Germany is close behind the Netherlands in second place, scoring more when it comes to the capacity for innovation and the number of electric vehicles. Following in third place is France, which scores highly for the quality of its road and transport infrastructure.

The UK comes fifth, above Sweden, Spain and Belgium. In terms of automated vehicles (AVs), it’s ahead of every European country apart from Germany. The UK and Germany both have legislation in place allowing people to drive AVs with significant restrictions. While every other country either has no legislation in development or is still at the testing stage.

At the foot of the index are Iceland, Greece and Poland, which score less than half what the top-ranked countries do.

Research from mobile computer developer Scandit revealed that different parts of Europe are dealing with different challenges and following varying investment priorities. For example, 43% of delivery companies in eastern Europe and Nordic countries are focusing on new apps and features. In southern Europe, by contrast, just 5% of companies are looking to produce new apps and functionality.

Luke Davies, Commercial Director at Courier Exchange, says:

“Demand for delivery services is showing no signs of slowing down, so to keep up, the sector will need to find efficiencies where it can. Innovation will play a huge role in achieving this and innovation will come in many guises.

“We’re certain to see drones and automated vehicles delivering packages in the coming years. And electric vehicles will, of course, be central to the future of the industry, particularly as the Ukraine war rumbles on and keeps fuel prices high.

“But there will also be plentiful change behind the scenes, in areas away from public view. For example, companies will increasingly lean on artificial intelligence to uncover ways of streamlining processes. The internet of things will feed data into AI systems, allowing for closer tracking of goods and better insight into traffic patterns. And AI will take over more and more processes and decisions.

“It’s vital that the delivery sector embraces technology and adapts, particularly when customers have become so used to convenience and speedy delivery. Customers are also demanding that the goods they buy are sustainable, at every stage of the supply chain.

“What’s encouraging is that so many European nations are well-positioned when it comes to innovation. Just how ready they are varies from territory to territory, but the overall picture is promising and once innovative practices become the norm – and are seen to be successful – other countries will introduce them.”

Methodology

The European Delivery Innovator Index analysed metrics associated with progress in the courier industry, to suggest which countries are best placed to support innovation in the delivery market.

San Marino, Andorra, Belarus and Liechtenstein were excluded from the final ranking due to a lack of available data.

Six categories were used to analyse each country:

- Number of charging stations per electric vehicle (EV)

- Capacity for innovation

- Transport infrastructure

- Road quality

- Government legislation for autonomous vehicles

Each factor was given a score to find the overall ranking. All data is normalised to a 0-100 scale, with the country closest to a score of 100 considered to have the most potential for delivery innovation.

While this research is not exhaustive, we’ve selected relevant metrics and conducted the research as thoroughly as possible.

Sources

Number of charging stations per electric vehicle (EV)

- https://www.iea.org/data-and-statistics/charts/ratio-of-public-chargers-per-ev-stock-by-country-2020

Capacity for innovation

Transport infrastructure

Road quality

Government legislation for autonomous vehicle

- Inspired by Confused.com analysis, we used the below scoring system:

- 4 = legislation / approval in place to drive AVs

- 3 = legislation / approval in place to drive AVs, but with significant caveats

- 2 = legislation / approval in place for testing AVs

- 1 = legislation in development

- 0 = nothing in place / in development

this post is on behalf of our partner Business Choice Direct

With the new number plates due out in September, here is what courier drivers should know if you’re thinking of changing vehicles. The 72-plate will apply to all new vehicles registered until February 28th, 2023.

Thinking of upgrading?

A Van or pick-up truck enables you to offer a broader scope of services thereby giving you access to a wider range of clients. Upgrading capacity could certainly enable you to undertake multiple drops and cover longer distances and a newer vehicle provides reliability and a potentially superior performance.

Is bigger better?

Van sizes are based around ‘wheelbases’, i.e., the length of the chassis, and confusingly you can get a long-wheelbase small van, or a short wheelbase large van. The other size measure is around Gross Vehicle Weight (GVW), which dictates the authorised weight the vehicle is allowed to be once loaded.

As to what size you get depends upon your contracts, but a small van could be the best starter vehicle for your business.

Mid-Panel Vans

This size is flexible enough for almost any courier requirement, so this could be worth the investment. Typically, with a load space length of around 2.4 metres, they are classed as ‘short wheelbase’ on Courier Exchange.

Large Panel Vans

For capacity, this is a size that offers greater scope with many economical options available.

Lease or Buy?

This is a difficult question to answer as no one size fits all, and it depends on your individual circumstances. Both options are tax deductible as expenses.

Leasing

Pros:

· Full-service leases are available which often include maintenance, repair, accident management, insurance and registration

· Cheaper up-front costs as total cost of leasing is spread out over the lifetime of the contract

· Good option if you don’t have the ready funds to buy one

· You are paying the same amount on the lease every month, which is consistent for budgeting.

Cons:

· Many leases don’t include insurance and you will have to organise it yourself. If insurance is provided, you must check that it is suitable for your business needs and offers the appropriate coverage for tools, commercial liability, and goods in transit insurance.

· You can’t adapt or modify the vehicle.

Buy

Pros:

· Total cost of purchasing is likely to be lower than leasing, making it economical in the long term

· You can trade in your older vehicle

· No restrictions on distance and mileage

· Make it your own and fine tune it to your needs- but be aware of any modifications that could impact upon your insurance

· Not financially tied to a monthly contract

Cons:

· You may need access to finance if you don’t have ready cash

· Additions/modifications could impact the cost of your van insurance premiums

· You have to pay for maintenance, tax and insurance yourself

· Allow for the depreciation of your van’s value over time

New or old, BCD have it covered

Whether you decide to take advantage of this September’s new plate release or not, you can always rely on the superior performance of our insurance partners, Business Choice Direct (BCD) https://rebrand.ly/BCDCrEx. Whatever vehicle you own, they have the expertise to ensure that you have the most appropriate cover.

Call them on 0344 776 5303 or Email: commercialleads@businesschoicedirect.co.uk

Business Choice Direct Insurance Services Ltd are authorised and regulated by the Financial Conduct Authority.

Business Choice Direct Insurance Services Ltd is registered in England and Wales No. 10301653. Registered Office: Affinity House, Bindon Road, Taunton, Somerset, TA2 6AA.

Calls are recorded for use in quality management, training and customer support.

As you may know, here at the Courier Exchange we don’t believe in standing still.

The Exchange is the UK’s biggest courier marketplace. It routinely grants couriers access to more than 10,000 loads per day. But rather than rest on our laurels, we’re always on the lookout for new ways to help our industry advance.

Earlier this month, our CEO, Lyall Cresswell, announced several new developments that are about to do just that. The developments really are going to change the logistics industry for the better. So, rather than keep them hush hush, you can read Lyall’s update in full below.

Dear Members,

I’m writing this to let you know about the imminent release of the most important developments that we have made to the Transport Exchange Group (TEG) platform over the past few years. Those of you who have been valued members of TEG (and our sub-brands Courier Exchange and Haulage Exchange) for many years will know that we do not believe in standing still and have a long-term vision to continuously improve user experience and reduce friction wherever possible in the process of dealings between our member businesses.

Over the past three years, despite the unprecedented backdrop of Covid, Brexit, Ukraine and the fluctuating and challenging economy, we have continued to make significant investments in the platform. This year will see us invest £4 million. This is testament to our long-term commitment to our members to develop the TEG platform and improve the user experience so that both are best in class.

Here are some of the highlights that we will be delivering over the next few months:

Trust and Security – taking this to a new level

You will soon be invited to enrol your business in our brand new transport compliance and digital identity platform ‘Trustd.net’. Three years in the making, this has been designed to handle onboarding, maintenance and monitoring of key business data used in the Exchange platform. Our aim is to elevate compliance standards and fair dealing both in TEG and also within the industry that we serve to a whole new level. Fully integrated with the TEG platform, Trustd will become the single source of truth for your business profile, whether you are an owner driver, fleet operator or non-asset based transport business.

Platform security is always at the heart of everything we do and with this in mind we will shortly be launching User Authentication and Multi Factor Authentication. You’re probably already familiar with these from the other secure online platforms that you use. This will further protect your platform login, as well as safeguarding other key account activity, such as when you change your profile or perform certain actions within the system. The ‘unique email’ implementation that you and other users in your account underwent earlier this year was the first stage in this process.

The Back Office – improving efficiency and reducing friction

As we all know, the process of paying and getting paid can be problematic and time-consuming in our industry. To alleviate this stress, we have completely re-built the Finance function for both Payables and Receivables. The invoice approval and payment process can now be 100% digital, ensuring unrivalled transparency, compliance, and cost-effectiveness for all parties. We have built new functionality into this area including batch invoicing, dispute handling and improved ‘private’ invoicing. Further, Payables and Receivables can also be fully integrated with your accounting software – see below.

Accounting Integrations – reduce your data handling

We have built comprehensive new integrations with the most popular accounting software packages, including Xero, Sage and Quickbooks, so you will now be able to export data seamlessly from TEG into these connected platforms which is valuable to meet your Making Tax Digital (MTD) obligations and most importantly to save you time.

Using TEG on the Road – our next generation mobile app

We launched the first version of our driver app back in 2004. Working with the TEG platform from the road has always been an essential part of our user experience and we are now in the process of building a completely new mobile app for both Drivers and Fleets. We will be inviting some of our members to ‘test drive’ the new app later this year and look forward to launching it in Q1 2023.

Data Transfer – the future is Integrated!

We live in an inter-dependent and connected world – the future of our industry depends on creating integrations so that data can be transferred in a secure and frictionless manner to and from the TEG platform to third party systems, including TMS and telematics. To this end, we have updated our API documentation and now have an in-house API specialist to demonstrate the benefits of integration and help to guide you through the implementation process.

Embedded Analytics

We’re launching ‘Analytics’ – a brand new section of the platform. For the first time you can see detailed reports on Supplier Insights as well as understanding how the freight transport market is performing.

But enough about the technology enhancements. How about other key aspects of the TEG member experience?

Our New Customer Support Centre

We know how important it is that we handle your questions and support tickets as quickly and accurately as possible. We have therefore recently opened a new dedicated Customer Support Centre in Chippenham, Wiltshire. I am delighted with the positive feedback that we have received so far and, whilst we appreciate that it can be hard to get it right every time, we are continually striving to provide the excellent level of support that you expect and deserve.

Our Team Continues to Grow

As well as our new Customer Services centre, we have been on a recruitment drive to hire experienced and energetic colleagues across all areas of our business. The Account Management and Product Development teams have seen their numbers grow in particular.

So as you can see we have been very, very busy!

We will be writing to you via email over the summer to keep you up to date with further information about how and when these important new developments will be available to your business.

In the meantime, enjoy the summer and please keep your feedback and suggestions coming – we value everything that you send us.

Yours faithfully,

Lyall Cresswell

Founder & CEO

Transport Exchange Group LimitedAs the courier industry is growing with soaring demand, how is the industry adapting to increased pressure and can more be done to support those working in it?

In the wake of Brexit and with fuel prices reaching record highs, the logistics industry is experiencing unprecedented demand nationwide. According to the Office for National Statistics (ONS), the number of business premises used for transport, logistics and warehousing in the UK has almost doubled in the last decade. A recent report from Mordor Intelligence found that parcel volume recently grew by 33%, year-on-year, reaching 5 billion in 2020, up from 3.8 billion in 2019.

As the UK’s leading return loads platform for self-employed courier professionals, we wanted to discover how those working in the industry are handling the workloads that come with growth – and the added pressure it brings. We asked 287 courier drivers and companies for their insights into everyday pressures, health & safety at work and work-life balance. We also asked businesses about their current priorities as the industry sees surging demand and they navigate through turbulent economic times.

The survey revealed that despite there being various obstacles for couriers and firms, they can be overcome with the right support.

Key findings

- Almost a quarter (23%) of courier companies have increased salaries/bonuses

- 47% of drivers want customers to better understand the pressure on delivery drivers

- Over one in eight couriers believe embracing technology can relieve everyday pressures

- 41% of self-employed drivers see smart motorways and the removal of hard shoulders as the biggest health & safety risk for 2022

- Almost two-thirds (62%) of courier companies see opportunities for growing their profits

- More than half (59%) of courier firms are looking to increase their customer base

- Over a third (37%) of firms don’t believe they’ll be impacted by new cabotage rules

How has the courier industry changed in recent years?

Unsurprisingly, as the country confined itself at home, the demand for deliveries surged. Half (51%) of the courier companies who took our survey said they deliver more parcels now than they did prior to Covid-19. According to the ONS, the proportion of UK retail sales taking place on the internet has risen by 51% over the last four years.

At the same time, the industry is coming under pressure from several angles, including staff shortages, government regulatory changes and higher costs.

As with many industries in recent years, increased demand has affected those working in the sector – half of all courier employees said that pressure caused them excessive stress or had a negative impact on their mental health. Almost two-thirds (61%) of business owners were affected by mental health issues, compared to 46% of self-employed drivers: pressure is having an impact at all levels in the courier industry.

Away from the clear health implications, this has impacted many companies’ bottom line. 57% of courier companies have noticed that higher levels of driver pressure have indirectly impacted company profits. These firms hope that they can help to alleviate some of these strains and see a corresponding uptick in their figures.

Courier businesses feeling the squeeze of rising costs

To understand where support is needed most in the courier industry, we asked drivers and companies which issues were most likely to jeopardise the commercial viability of their businesses/jobs. Unsurprisingly, 90% feared the impact of rising fuel prices, and almost three-quarters (72%) cited increased costs of operating.

Challenges are also posed by government clean air initiatives, according to around a third of respondents. Not only are a growing number of UK cities introducing low emission or clean air zones, but some are also widening these zones and/or charging more to travel through them. The expansion of such initiatives is another rising cost companies are experiencing.

How are industry pressures impacting couriers on the ground?

Our study highlights the increased demands that have been placed on couriers – 85% of couriers state that (over the last two years) they’ve regularly experienced excessive physical demands on the job. Raising awareness of challenging aspects of the job is key to making them – and couriers’ work-life balance – more manageable.

With demand for courier services so high, a quarter of the couriers we surveyed have regularly worked six-day weeks in the last couple of years. If drivers are to take advantage of this rocketing demand, they need greater support. Half (56%) of couriers regularly missed a lunch break and over a third (36%) have slept in their vehicles.

Sometimes, the demands couriers face become unacceptable. Almost 1 in 5 (18%) have been physically or verbally assaulted by a customer, and 7% have even had a customer chase their vehicle.

How can pressure be relieved?

Overwhelmingly, couriers believe that driver pressure could be lessened if customers understood the strain they’re put under. Almost half (47%) of the drivers surveyed thought customers’ perceptions were key, while others saw issues with client expectations, delivery options and mental health support.

Among self-employed drivers, almost two-thirds (63%) said improved legislation for self-employed people would lead to less pressure.Improving collaboration and understanding between industries is key

Amid continuing supply chain problems in the UK, courier companies are sometimes struggling to meet demand. Some are even reluctant to work with certain industries, who they’ve found put more pressure on their delivery service. The industries couriers identified as putting most pressure on them are:

- Construction - 21%

- Food & drinks product - 21%

- Agriculture, forestry and fishing - 18%

- Health / medical - 16%

- Hospitality, events & food service - 15%

- Retail - 15%

- Fashion - 9%

- Commercial & consumer garden - 8%

- Consumer beauty & cosmetics - 6%

- Manufacturing - 4%

Logistics is closely entwined with other industries, with supply chain issues affecting every sector when they occur. Enhanced understanding and support between sectors is, therefore, essential in overcoming the economic obstacles and external pressures so many businesses are currently experiencing.

What do self-employed drivers currently see as the biggest risks to health & safety?

Two in five drivers (41%) saw smart motorways and the removal of hard shoulders as a significant danger. While a similar proportion (37%) viewed long journeys with insufficient breaks as a serious problem.

A quarter (27%) believe excessive stress and workplace pressure is a real risk to their wellbeing and, as the survey has highlighted, there are various triggers that cause drivers stress.Another consideration is time spent alone on the job, which will clearly have a mental health impact. One in five (21%) drivers are concerned about the solitary nature of the role.

Uncovering driver concerns is the first step towards alleviating such stresses. The government can also help by implementing extra safety measures and rest areas for drivers.

How have political and regulatory changes impacted the courier industry?

The courier industry continues to navigate through the political and regulatory impacts of the Brexit transition.

The impact of Brexit

In addition to all the other issues they face, 15% of self-employed drivers said Brexit regulations and associated industry changes regularly put pressure on their operations. One out of 10 drivers even highlighted changing driver regulations as the greatest risk to drivers’ health & safety in 2022.

Some 16% of all drivers and companies said Brexit regulations are threatening the very commercial viability of their work. Also, 9% of couriers say the new EU cabotage rules will put serious pressure on their work, affecting their job security or the future of their company.

What’s certain is that the vast majority of companies are narrowing their focus to the UK: expanding operations in the EU is a priority for just 5% of them.

How prepared are courier companies for new cabotage rules?

One of the biggest challenges courier companies and drivers face is changing cabotage rules. As of May 2022, even courier drivers taking goods to the EU must have a community licence and fulfil various requirements, meaning more Brexit bureaucracy. According to our survey, 63% believe they’ll be impacted.

Yet almost a quarter (24%) of courier businesses don’t understand the new cabotage rules and aren’t prepared for their implementation. Only 5% of those that understand the rules think they won’t be impacted.

Where are courier companies focusing their efforts?

In an industry that’s developing quickly and increasingly embracing new technology, courier companies are looking to the future and expansion opportunities. Despite the industry growth, there are a section of couriers looking to pivot their business model in response to a shifting market landscape. These are companies’ primary objectives:

- Growing profits - 62%

- Increasing customer base - 59%

- Pivoting business model to stay afloat - 27%

Reacting to staffing challenges in the past two years, two-thirds (66%) of businesses have implemented some kind of measure to attract staff. This is how they’ve done it:

- Increased salaries/bonuses - 23%

- Referral schemes - 10%

- Increased their social media presence - 8%

Almaz Cleary, sales manager at Courier Exchange, says:

“During Covid-19 lockdowns, delivery drivers were rightly recognised as essential workers, with the country realising just how important they are to modern living. It’s been an incredibly tough two years for them, work-wise, with workloads heavier than ever and Brexit just one of the factors complicating their everyday routines.

“What we’re seeing in this survey is the far-reaching nature of the pressures. However, identifying and understanding them is key to progress being made.

“It’s also great that so many companies are looking to technology as a way to help with everyday stresses. We are committed to building technology that has a pivotal part to play in alleviating supply chain pressures. Digital transformation is how the industry will grow and prosper even further.”What’s happening?

Drivers moving goods from the UK to the EU, Norway, Iceland, Liechtenstein and Switzerland will soon need a ‘standard international goods vehicle operator licence’ to transport goods commercially.

When do the rules begin?

The new rules begin on Saturday 21st May 2022.

Who’s affected?

You’re affected if you

- Transport goods commercially from the UK to the EU, Norway, Iceland, Liechtenstein and Switzerland using either:

- A van with a maximum authorised mass of over 2500kg and up to and including 3500kg, or;

- A car/van towing a trailer with a gross train weight of over 2500kg and up to and including 3500kg

What’s a ‘maximum authorised mass’?

A maximum authorised mass is the weight of a vehicle or trailer plus the maximum load it can safely carry.

What’s a ‘gross train weight’?

A gross train weight is similar to a maximum authorised mass. It’s the total weight of a tractor unit, plus its trailer, plus the trailer’s maximum safe load.

How do I see affected loads in Courier Exchange?

Just look for a ‘Euro Load’ link on the Quotes screen.

This affects me. How do I comply?

You can either:

- apply for a standard international goods vehicle operator licence for the first time

- add vehicles to your standard international goods vehicle operator licence (if you’re already doing international courier work and therefore have a licence)

- apply to upgrade your standard national goods vehicle operator licence (if you have one) to a standard international goods vehicle operator licence

- apply to upgrade your restricted goods vehicle operator licence (if you have one) to a standard international goods vehicle operator licence

How do I apply for a new licence?

You can apply for a new licence here.

How long before my licence is granted?

It can take up to 9 weeks to issue a licence following an application. If you need a licence sooner, you can apply for an interim licence when you apply for a full licence.

(Please note: application success is not guaranteed.)

How much do licences cost?

Licence applications cost £257 and, if successful, licences cost a further £401. A continuation fee of £401 applies every five years thereafter.

Where can I find out more?

You can find out more via the UK government’s website.

In 2022 there will be two lots of changes to road haulage through the EU member states for UK-based hauliers which could affect your business.

The dates for your diary are February 2 and May 21.

Postings Declarations

From February 2, UK operators of HGVs, vans of any size, or cars with trailers traveling within the EU member states, Norway, Iceland and Liechtenstein for commercial purposes will need to register the journey on an online government website.

The information required to register the journey is:

- operator licence number (if applicable)

- details of drivers and a transport manager or other UK contact

- dates of driver’s recent employment contracts/agency contracts

- estimated journey start/end dates

- number plates of vehicle and trailer

These Postings Declarations are required for any commercial journey between two points within this area. These journeys can include:

- Cabotage jobs – loading and unloading within the same country.

- Cross-trade jobs – Loading in one country and unloading in another.

- Moving goods for your own business – even if your business is not about moving goods in general.

Drivers must also ensure they are carrying certain documents in case the EU authorities should ask for them. These include:

- Digital or physical copies of the Postings Declarations

- Vehicle and trailer documents

- Driver documents

- Export documents

- Documents about the driver’s pay during the journey

- The driver’s employment contract

- The driver’s timesheets for work

Failure to show these documents could end up with a penalty.

Standard International Goods Vehicle Operator Licence

From May 21 UK-based operators who use vans with an authorised mass between 2.5-3.5 tonnes, and cars or vans with trailers amounting to the same weight are now required to have a standard international goods vehicle operator licence to transport goods for commercial purposes.

This is applicable to journeys within EU member states, as well as Norway, Iceland, Liechtenstein and Switzerland.

Current operator licence holders can add these vehicles to their current licences. To do this is free if you haven’t already reached your vehicle limit. It will cost £257 to increase the number of vehicles on your licence if the limit is exceeded.

To apply for a new licence will cost £257 and if successful the licence will be a further £401. Then there is a continuation fee every five years of £401 to keep the licence active.

This does not apply to you if you only use your vehicles within the UK or you are transporting for non-commercial purposes.

Drivers will need to carry a copy of the UK Licence for the Community with them on international journeys.

Penalties

There will be legal penalties for UK-based drivers not registering their journeys or for not having the correct operator licence. These could include withdrawing the Community Licence or being issued with a fine.

Next Steps

As the first deadline of February 2nd has already passed, you can check the government website to keep abreast of any changes.

Share this post on LinkedIn

Solutions

Resources

Support

About

2000 - 2025. Transport Exchange Group Ltd, Reg No. 3464353 © E&OE

- Owner drivers